📌 Introduction

🔍 What is Blockchain?

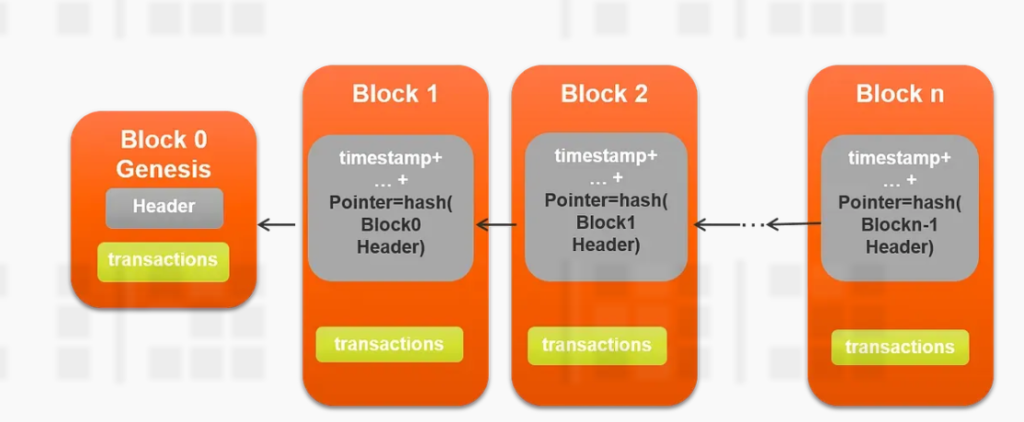

Blockchain is a distributed, decentralized ledger technology that records transactions in a secure, verifiable, and immutable way. Unlike traditional databases controlled by a single entity, blockchain operates on a peer-to-peer network where every participant maintains a copy of the ledger. Blocks are chained together via cryptographic hashes, ensuring historical records cannot be tampered with.

🌍 Why It Matters for Developers, PMs, and Business Leaders

- Developers: Need to understand underlying protocols, smart contract execution, and node infrastructure to build decentralized applications.

- Product Managers: Must align product vision with decentralized user needs, identify PMF (Product-Market Fit) in blockchain-based ecosystems, and bridge engineering and commercial goals.

- Business Leaders: Benefit from understanding blockchain’s role in transforming trust, lowering transaction costs, and improving transparency.

🔧 Core Concepts

📜 Distributed Ledger Technology

A DLT is a consensus of replicated, shared, and synchronized digital data spread across multiple sites. Blockchain is a form of DLT where every transaction is verified by consensus and added to the ledger as a new block.

⚙️ Consensus Mechanisms

| Mechanism | Description | Examples |

|---|---|---|

| PoW | Nodes solve computational puzzles | Bitcoin |

| PoS | Validators stake tokens to verify blocks | Ethereum 2.0 |

| DPoS | Delegated reps validate transactions | EOS |

| PBFT | Fast, secure consensus among known parties | Hyperledger Fabric |

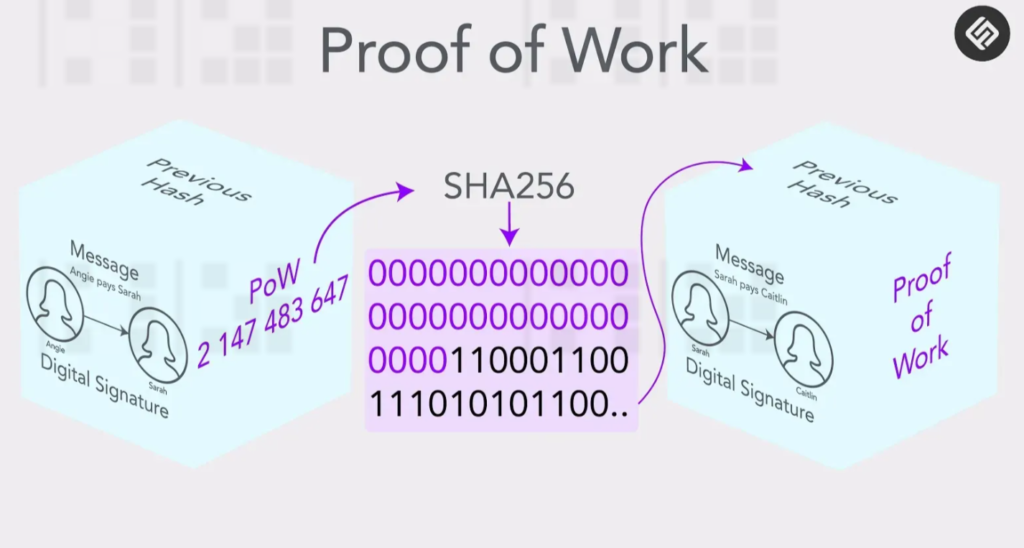

🔐 Blocks, Hashing, and Immutability

- Each block contains a timestamp, transaction data, and a reference to the previous block via hash.

- Hashing ensures data integrity. If any block is altered, the chain becomes invalid.

- Merkle Trees allow efficient and secure verification of large datasets.

⚖️ Smart Contracts

Self-executing code deployed on a blockchain. Conditions are defined in logic, and execution is automatic once triggered.

pragma solidity ^0.8.0;

contract PaymentSplitter {

address public recipient;

constructor(address _recipient) payable {

recipient = _recipient;

}

function release() public {

payable(recipient).transfer(address(this).balance);

}

}

🧩 Public vs Private Blockchain

| Feature | Public Blockchain | Private Blockchain |

|---|---|---|

| Access | Open to all | Restricted to known parties |

| Governance | Decentralized | Centralized |

| Consensus | PoW, PoS | PBFT, RAFT |

| Speed | Lower | High throughput |

Permissioned vs Permissionless

- Permissioned: Only authorized participants can validate and view transactions (e.g., consortium blockchains).

- Permissionless: Open to anyone (e.g., Bitcoin, Ethereum).

Use Cases

- Public: NFTs, DeFi, global asset transfers

- Private: Internal settlements, document authentication, regulatory compliance

🏗 Blockchain Architecture

🧱 Full-Stack Architecture

+----------------------------+

| UI Layer (Wallets, DApps)|

+----------------------------+

↓

+----------------------------+

| Middleware (SDKs, APIs)|

+----------------------------+

↓

+----------------------------+

| Smart Contracts / dLogic |

+----------------------------+

↓

+----------------------------+

| Blockchain Core (VM, Consensus, State) |

+----------------------------+

↓

+----------------------------+

| Network + Storage (P2P, IPFS, Gossip) |

+----------------------------+

Components

- Nodes: Participate in consensus and hold the ledger.

- Validators: Ensure integrity of transactions.

- Wallets: Interface to sign and send transactions.

- Explorers: Provide visibility into on-chain data.

- Layer 1 vs Layer 2:

- Layer 1: Ethereum, Solana (base protocols)

- Layer 2: Polygon, Arbitrum (scalability overlays)

🔁 Workflows & Technical Flow

🔄 Transaction Lifecycle

- Transaction created via DApp

- Signed by private key via wallet

- Broadcasted to mempool

- Validators confirm and add to block

- Block reaches consensus and is appended

🌐 Node Communication

- Peer-to-peer messaging (Gossip protocol)

- Transaction propagation → block proposal → finality

🧠 Wallet → DApp → Smart Contract Flow

- User triggers transaction

- Wallet (e.g., MetaMask) signs it

- Contract executes logic and changes state

💻 Code Snippets

Smart Contract Deployment (Hardhat)

npm install --save-dev hardhat

npx hardhat

async function main() {

const Contract = await ethers.getContractFactory("PaymentSplitter");

const contract = await Contract.deploy("0xRecipient");

await contract.deployed();

console.log("Deployed to:", contract.address);

}

main();

Web3.js Example

const Web3 = require('web3');

const web3 = new Web3("https://mainnet.infura.io/v3/<API_KEY>");

web3.eth.getBalance("0xAddress").then(console.log);

🚀 Use Case Deep Dives

🌎 Cross-Border Payments

- Reduce remittance costs with stablecoins

- Instant clearing vs T+3 delays of SWIFT

- Automated FX conversion via oracles

🏷 Tokenized Assets

- Real estate, art, invoices tokenized on-chain

- Fractional ownership via NFTs or fungible tokens

🧾 Digital Identity

- Users control personal data via DID

- KYC via verifiable credentials

📦 Supply Chain

- Timestamp and hash product journey

- Increases transparency, reduces fraud

⚙️ Challenges and Scalability

⛓ The Trilemma

| Factor | Description |

|---|---|

| Scalability | Throughput vs decentralization |

| Security | Resilient to attacks, data integrity |

| Decentralization | Avoid single points of control |

Solutions

- Sharding: Parallel chains

- Rollups: Off-chain compute, on-chain proofs

- State Channels: Off-chain settlement

- Sidechains: Independent chains pegged to L1

🔮 Future Trends

🔗 Interoperability

- Cosmos IBC, Polkadot parachains for cross-chain communication

🧠 AI + Blockchain

- Secure AI input audit trails

- Model marketplaces

🧮 Zero-Knowledge Proofs (ZKPs)

- Prove without revealing underlying data

- Applications in identity, private payments

🛠 Regulation, ESG

- Compliance-ready blockchain

- Lower energy consensus (PoS, PoA)

My Deep Thoughts 🧠❤️

Regulatory Landscape: In the early years, cryptocurrencies operated in a legal gray zone, but today virtually every major economy is crafting or enforcing rules for blockchain-based assets. Governments have a dual mandate: prevent illicit use and protect consumers, while not stifling innovation. Approaches vary widely:

- Permissive and Structured: Some jurisdictions openly embrace blockchain and crypto with clear regulations and licensing regimes. For example, several countries in Europe, the Middle East, and Asia have introduced comprehensive frameworks (like the EU’s MiCA regulation) to license crypto exchanges, mandate investor disclosures for token offerings, and supervise stablecoins. These rules treat many crypto tokens akin to traditional financial products (securities, e-money, commodities) and impose standards accordingly. The goal is to legitimize the industry under the law – requiring robust KYC/AML compliance by exchanges and custodians (to prevent money laundering and terrorism financing), consumer protection measures (such as segregation of customer assets, fit-and-proper management of exchanges), and market integrity rules (surveillance against fraud and manipulation). For instance, a crypto exchange in such a jurisdiction might need to obtain a license similar to a securities broker, implement the FATF “travel rule” (sharing sender/receiver info for large transfers), and ensure transparency of fees and risks to customers. The upside is a more secure environment for users and institutional investors – more clarity often leads to higher adoption. Over a dozen countries have also approved Bitcoin-based financial products (like futures, ETFs) within traditional markets, reflecting a regulatory comfort after setting rules.

- Cautious and Restrictive: Other countries take a wary stance, partially banning or strictly limiting crypto activities. According to one study, among 60 surveyed nations, 33 permit crypto with legal frameworks, 17 have partial bans, and 10 enforce general bans. For example, some governments prohibit crypto exchanges from operating or bar banks from touching crypto, effectively pushing trading into underground or peer-to-peer channels. These bans often cite concerns over capital flight, investor scams, or destabilization of monetary systems. One prominent example is a major economy that banned crypto trading and mining domestically in 2021, opting instead to explore a state-controlled digital currency. In such environments, innovation tends to shift to friendlier shores – developers and startups may relocate to jurisdictions with clearer, more permissive laws. On the other hand, licensed private blockchain uses (like enterprise DLT) are usually not banned; many restrictive regimes still invest in blockchain for supply chain or central bank digital currency (CBDC) pilots, even if they crack down on public crypto trading.

- Middle Ground (Wait-and-See): Many countries are still refining their approach. They might not have dedicated crypto laws yet, but apply existing laws case-by-case. For instance, regulators might declare that certain tokens are securities (if they represent investment contracts) and thus fall under securities law – requiring registration of offerings and anti-fraud controls – whereas utility tokens or payment tokens might be treated differently. The United States, for example, has taken this approach: the SEC has brought enforcement against numerous ICO issuers for selling unregistered securities, arguing those tokens were essentially stocks in disguise. At the same time, U.S. banking regulators have given guidance on how banks can custody crypto or use blockchains for settlement, and the IRS has issued tax rules (treating crypto as property, so each taxable disposition triggers capital gains calculation). This piecemeal strategy can create uncertainty – e.g., debates over whether a particular digital asset (say a DeFi governance token) is a security or not. The trend, however, is toward more explicit categorization: lawmakers are drafting bills to define digital assets and which agencies oversee them. By 2025, several countries (Japan, Switzerland, Singapore, UAE, among others) have set up special crypto licensing or sandbox programs to allow compliant growth of the sector, signaling that a global regulatory convergence is slowly happening.

Key Regulatory Themes Globally:

- Anti-Money Laundering & KYC: Almost universally, countries now require crypto exchanges and brokerages to implement AML programs like other financial institutions. This means verifying customer identity (KYC), monitoring transactions, and reporting suspicious activity. In practice, major exchanges ask for passports or IDs on sign-up and use blockchain analytics to flag illicit funds. jurisdictions that once had loosely regulated exchanges (e.g., some “crypto havens”) have tightened standards or risk being gray-listed by international bodies. Privacy advocates note tension here: overly strict AML rules can erode the pseudonymity that is a feature for some users. But regulators argue that the same controls that apply to bank wires (which similarly can be traced) should apply to large crypto transfers to combat crime. As a result, privacy coins and mixers face regulatory pressure – some exchanges delist coins like Monero or Zcash due to regulatory concerns, and a notable mixer service was sanctioned by U.S. authorities in 2022 for allegedly facilitating money laundering. Going forward, expect increased use of privacy-preserving compliance tools (like zero-knowledge proofs that allow KYC verification without sharing full data) to reconcile privacy with regulation

- Consumer Protection & Education: Regulators worry about retail investors being defrauded or taking on outsized risk in volatile crypto markets. Many have issued warnings that crypto assets are high-risk and not insured. Some countries restrict retail access to certain high-risk products: for instance, banning crypto derivatives trading for amateurs, or requiring exchanges to have risk disclosures and suitability checks. We have seen high-profile collapses of crypto exchanges and lending platforms – regulators respond by pushing for custodial standards (e.g., proof-of-reserves audits, capital requirements, mandatory disclosures of how customer funds are stored or if they’re lent out). The aim is to prevent “another 2022 scenario” where a big exchange’s failure caused users to lose funds. In some regions, self-regulatory organizations (SROs) made of industry players work with regulators to set conduct codes. By 2025, a few jurisdictions have implemented or proposed investor compensation schemes or strict segregation for crypto custodians, so that if a custodian goes bankrupt, user assets aren’t treated as part of the bankruptcy estate (the way securities are protected by law in traditional finance)

- Securities and Token Offerings: A central regulatory question: When is a token a security? This matters because securities (like stocks, bonds, investment contracts) are heavily regulated: issuers must register offerings or qualify for exemptions, provide prospectuses, and are subject to ongoing reporting and investor protections. Many initial coin offerings (ICOs) in 2017-2018 offered tokens to raise funds for projects – economically similar to selling equity – but without following securities laws, leading to enforcement actions and some investor losses. Now, regulators commonly apply the “Howey Test” (from U.S. law) or similar criteria: a token is a security if it is sold as an investment in a common enterprise with expectation of profits primarily from efforts of others. By those standards, a great number of ICO tokens and DeFi governance tokens likely qualify. Consequently, jurisdictions are bringing such tokens under securities laws. Some projects opt to register their token sale with authorities or limit sales to accredited investors to comply. Others move offshore or decentralize token distribution to claim they aren’t securities. This remains a contentious area – e.g., court cases like the SEC vs. Ripple (over XRP token) have been closely watched for precedent. Globally, we see a patchwork: a token might be deemed a utility in one country but a security in another. The trend is toward clearer definitions: the EU’s MiCA, for example, creates categories of “asset-referenced tokens,” “e-money tokens,” and others, each with specific rules, effectively covering stablecoins and other crypto assets in a bespoke way rather than shoehorning them into old categories. We can expect by the late 2020s more uniform treatment, enabling compliant tokenization of stocks, bonds, and real-world assets (security tokens) on regulated exchanges. Already by 2025, licensed platforms in Switzerland, Germany, etc., are trading tokenized bonds and equities under existing law, showing that regulation and innovation can meet.

- Stablecoins and Banking: Stablecoins (crypto tokens pegged to fiat, like USD) grew tremendously in use, raising concerns since they behave like money but are issued by private companies. Regulators worry about reserve integrity (does the issuer truly hold $1 of safe assets for each token, to prevent a collapse or “run”?) and the systemic impact if a major stablecoin failed. In response, some jurisdictions have proposed treating stablecoin issuers akin to banks or e-money institutions. They may require stablecoin issuers to obtain licenses, hold reserves only in certain ultra-safe forms (cash, short-term government bonds), undergo audits, and in some cases, even be insured or have access to central bank support

. For example, Japan passed a law requiring that yen-pegged stablecoins can only be issued by licensed banks, trust companies, or licensed money transfer agents, effectively ensuring oversight. The EU’s MiCA similarly mandates that issuers of significant stablecoins maintain stringent capital and liquidity measures and can even be capped in circulation if they pose monetary stability risks. On the other end, some governments (like in developing nations with unstable currencies) outright ban or discourage stablecoins to prevent circumvention of capital controls. Meanwhile, Central Bank Digital Currencies (CBDCs) have emerged as a regulatory counterpoint: rather than regulate a private stablecoin, a central bank might issue its own digital currency on blockchain or similar tech. Over 100 countries are exploring CBDCs; a few (Nigeria’s eNaira, The Bahamas’ Sand Dollar, China’s e-CNY pilot) are already live. These CBDCs are typically permissioned blockchain-based or distributed ledger systems with the central bank at the helm. In the next 5–10 years, we may see major currency CBDCs (e.g., digital euro, digital dollar) which could coexist or compete with private stablecoins. Regulation will define how private and public digital currencies interact (for instance, requiring stablecoins to be fully redeemable for central bank digital currency, effectively making them narrow-bank substitutes).

- Taxation and Reporting: Tax authorities worldwide have caught up to crypto: they now routinely require individuals to report crypto gains, and exchanges in several countries must report user transactions to tax authorities (similar to stock broker 1099 forms in the U.S.). Initially, crypto’s pseudonymity led to under-reporting of taxes, but enforcement is tightening. Many countries treat crypto trades as subject to capital gains tax; using crypto to pay for goods triggers a taxable event (with some exceptions being discussed – e.g., proposals in the U.S. to exempt small personal transactions, say under $200, from tax to facilitate crypto-as-currency). Going forward, expect more automatic reporting: for example, the OECD has developed the Crypto-Asset Reporting Framework (CARF) to facilitate information sharing among tax authorities on crypto holdings, akin to how bank accounts are shared via CRS. Blockchain itself could also aid tax compliance; some jurisdictions have contemplated or implemented blockchain for tracking VAT and invoices to reduce fraud (e.g., Brazil was exploring a national blockchain system to record receipts). In short, the taxman is now very much in the loop on blockchain activities.

- Global Coordination vs. Arbitrage: Because blockchain is borderless, inconsistent rules can lead to regulatory arbitrage projects gravitate to lenient jurisdictions. We’ve seen smaller nations (Malta, Gibraltar, Bermuda, etc.) establish crypto-friendly laws to attract business, while larger economies formulate stricter rules. This dynamic pushes toward global coordination. Bodies like the G20, FATF, IOSCO, and BIS regularly discuss crypto regulations to harmonize approaches. Already, FATF’s AML standards are adopted by over 200 jurisdictions, and the travel rule is being implemented globally

The EU’s MiCA will create a single market across 27 countries, likely pressuring others to follow suit or risk fragmentation. We can foresee by the end of the decade a set of international norms: basic licensing for crypto service providers, technical standards for interoperability and security, and cross-border supervisory cooperation (for instance, to handle a collapse of a large global crypto firm, akin to how banks are handled). Regulation tends to legitimize technology once it’s in place – ironically, the very clarity that some crypto purists fear, is what many institutions waited for to participate. We’re already seeing more institutional involvement (banks offering crypto custody, ETFs, payment giants enabling crypto purchases) in jurisdictions with clear rules

Balancing Innovation and Protection: Regulators often use “sandbox” programs to let blockchain startups test products under supervision and limited scale before full licensing. This has spurred innovation in fintech and blockchain while keeping an eye on risks. Many jurisdictions also differentiate blockchain use cases:

- Purely private/enterprise blockchain projects (with no public speculation involved) generally don’t face consumer financial regulation, though data privacy law and cybersecurity law still apply. In fact, governments themselves are adopting private blockchain solutions (for land registries, customs, voting pilots, etc.), effectively endorsing the tech portion while separating it from the open cryptocurrency realm.

- Public decentralized finance (DeFi) poses a fresh challenge: by design, DeFi protocols have no central operator. Regulators are debating how to enforce rules in such cases. Some strategies include regulating the interfaces (forcing websites or app stores that facilitate DeFi access to include warnings or KYC gating) or targeting key contributors (as seen when the U.S. sanctioned a DeFi “mixer” protocol – essentially treating code as an entity to sanction). These are legally uncharted waters. The coming years will likely see attempts to bring DeFi into compliance by encouraging or mandating decentralized protocols to build in risk controls. Paradoxically, this is hard if the protocol is truly autonomous – it raises questions akin to regulating the internet. We might see the emergence of certified “regulated DeFi” platforms where governance tokens are held by identifiable parties who ensure AML compliance on that protocol, running parallel to more anarchic DeFi which might remain niche or peer-to-peer.

- Privacy and Data Regulation: Blockchains store data immutably, which can conflict with laws like Europe’s GDPR that grant a “right to be forgotten.” Regulators and developers are exploring solutions like off-chain storage with on-chain hashes, so personal data can be erased off-chain if needed while the chain only has a nonsensical hash. Another approach is encryption of on-chain data where only the user holds the key – so even if data is on-chain, it’s unintelligible to others and effectively deleted if the user deletes the key. Regulators will likely clarify that certain blockchain roles (e.g., a node operator) might be considered data “processors” under law if personal data is on-chain, which could impose duties on them. This is an evolving legal frontier: by 2025, some guidance in the EU suggests that permissionless chains need innovative compliance techniques (like zero-knowledge proofs for consent). The technical-regulatory interplay is prompting privacy-preserving blockchain designs that align with legal privacy rights.

Government Attitudes: Overall, the global stance has moved from skepticism to cautious engagement. Many central banks and finance ministries acknowledge the potential efficiency gains of blockchain (for example, faster settlement reducing systemic risk) and are themselves experimenting – a notable case is a consortium of central banks using a distributed ledger for cross-border interbank payments (Project mBridge, for instance). Even where retail crypto is discouraged, enterprise or state-run blockchain uses are often encouraged.

This indicates that while speculative crypto trading may be curbed, the underlying technology is respected and being incorporated into the future of infrastructure. For example, land registries on blockchain exist in countries in Europe, Central America, and Asia, providing tamper-proof property records. Electoral commissions are testing blockchain for voting transparency in minor elections or proxy voting. These government-led projects reinforce that regulation doesn’t equate to opposition; rather, it’s about integrating blockchain responsibly into existing legal systems.

The Next Decade of Regulation: We can expect:

- More Clarity: By 5–10 years from now, key definitions (what is a security token, utility token, stablecoin, NFT, etc.) will be codified in law in most major jurisdictions, removing much ambiguity. This will pave the way for broader institutional adoption of tokenization (as legal certainty around tokenized stocks/bonds/property will allow traditional investors to embrace them)

- Central Bank Digital Currencies (CBDCs): At least a few reserve currency CBDCs will likely be live. This could either complement or compete with private crypto. Regulations will address how CBDCs and cryptos interact – for instance, some countries might require domestic payments above a threshold use CBDC for transparency, or conversely might allow stablecoins that meet strict criteria to operate alongside CBDCs. The relationship between public and private digital money will be a key regulatory focus (ensuring stability and interoperability).

- Licensing of Decentralized Services: Regulators may devise creative ways to impose compliance on decentralized platforms – possibly through regulating key endpoints (like requiring DAO-operated protocols to register or face geoblocking by regulated gateways). There may emerge “regulated DeFi” pools that institutional money can use, which follow codes set by regulators (e.g., only whitelisted addresses can interact, fulfilling compliance). Unpermissioned DeFi might persist in parallel, but larger players will gravitate to compliant versions.

- Security and Insurance Requirements: We might see mandated cybersecurity standards for blockchain entities (to prevent hacks of exchanges, etc.) and even insurance or guarantee funds. For instance, exchanges might be required to insure hot wallet funds or contribute to an industry insurance fund to cover hacks or failures, similar to deposit insurance for banks.

- International Cooperation: Because crypto is global, regulators will increasingly cooperate. Already enforcement is international (e.g., U.S. working with foreign regulators to tackle cross-border crypto fraud; Interpol focusing on crypto crimes). We may see treaties or mutual recognition – e.g., if a token is approved under EU law, other jurisdictions might fast-track it, and vice versa. Global fora will continue issuing best practices.

- Balanced Tone: As the industry matures under regulation, the rhetoric is shifting from “crypto is the Wild West” to “blockchain is part of the future of finance/commerce, we just need the right guardrails.” This legitimization through regulation ironically fulfills one of the blockchain community’s goals (mainstream acceptance), albeit at the cost of some of the radical freedom that early crypto users enjoyed.

In conclusion, regulation of blockchain and crypto is rapidly evolving from nascent patchwork to a more harmonized global framework. While some countries still impose outright bans, the overall trend is to integrate blockchain into the existing financial and legal systems through prudent oversight

Sensible regulation brings many benefits: it deters bad actors (scammers, money launderers), protects consumers and investors, provides certainty for businesses (attracting institutional capital), and encourages technological innovation within clear rules. Of course, striking the right balance is challenging – over-regulation could smother the decentralized ethos and drive activity underground, whereas under-regulation invites chaos and abuse. The current stance worldwide is an ongoing calibration, but compared to a decade ago, there is much more clarity. Governments now recognize that blockchain technology itself is not to be feared – rather, it’s about managing the uses of that technology. As one report succinctly put it, blockchain is moving from a regulatory Wild West to a future of “regulated innovation,” where the benefits can flourish under the rule of law

Current Challenges in Blockchain

Despite significant progress, today’s blockchain systems face several critical challenges that must be addressed for broader adoption. The most prominent issues include scalability, privacy, user experience (UX), interoperability, and energy consumption. These challenges are often interrelated (solving one can impact another) and represent active areas of research and development in the community.

Scalability (Throughput and Latency)

Scalability – the ability to handle a growing volume of transactions with acceptable speed – is perhaps the most discussed challenge. Major public blockchains (like Bitcoin and Ethereum) have much lower throughput than traditional centralized systems. For example, Bitcoin handles around 5-7 transactions per second, and Ethereum in its current form roughly 15–30 TPS

In contrast, payment networks like Visa average on the order of 1,700 TPS

(and claim peak capacity in the tens of thousands). Moreover, block confirmation times (10 minutes for Bitcoin, ~12 seconds for Ethereum) introduce latency that is unsuitable for certain real-time applications.

Why is it hard to scale? Blockchains prioritize decentralization and security: every node in a traditional public blockchain processes every transaction and stores the entire ledger. This ensures trust (no need to trust a few nodes – everyone verifies everything) but severely limits throughput due to redundant processing and network broadcast constraints. Additionally, maintaining decentralization means requiring modest hardware so that many people can run nodes; this caps parameters like block size and frequency to avoid overwhelming nodes with average computational power and network bandwidth. This trilemma between scalability, decentralization, and security (often called the Blockchain Trilemma) posits that improving throughput without sacrificing security often entails increasing centralization (fewer, more powerful nodes)

Current impact: Limited scalability leads to network congestion and high fees at times of peak demand. We’ve seen CryptoKitties clog Ethereum in 2017 or DeFi yield farming in 2020 causing transaction fees of tens or even hundreds of dollars, pricing out small users. This undermines the promise of accessible finance for all. Similarly, Bitcoin’s limited throughput makes it less practical as a everyday payments network without help from layer-2 solutions (hence the push for the Lightning Network to offload small payments).

Solutions in progress: Multiple approaches are being pursued:

- Layer 2 Scaling: As discussed in the next section, techniques like payment channels and rollups move transactions off-chain (or compress many into one) while relying on the main chain for security

.This dramatically improves effective throughput. For instance, rollups on Ethereum today have achieved hundreds to thousands of TPS in practice, lowering fees 10-100x compared to L1. The widespread adoption of layer-2 networks (Optimistic and ZK-Rollups) in the Ethereum ecosystem in 2023-2024 has already eased congestion; still, it adds complexity and the need for users to bridge funds between layers.

- Sharding: This involves splitting the blockchain’s workload across multiple “shards” (parallel chains) that handle different subsets of transactions and smart contracts. A shard only processes its own transactions, and a coordinating mechanism ensures overall consistency. Ethereum’s roadmap includes sharding (post-Merge) to potentially boost throughput massively by having, say, 64 shards doing work in parallel (which could multiply TPS by a similar factor, pending implementation). Other blockchains like Polkadot and Cosmos achieve parallelism via parachains or zones, respectively – separate chains that run concurrently and intercommunicate with the main relay chain Sharding is complex to implement (especially ensuring cross-shard atomicity and security), and pure sharding in a decentralized setting remains largely untested at the scale of Ethereum’s user base (expected in the coming years).

- Alternative Consensus and Architecture: Some newer blockchains (Solana, for example) use more aggressive designs – a combination of Proof of Stake and optimized network engineering – to achieve higher throughput on a single chain (Solana claims tens of thousands of TPS under ideal conditions. They do this by requiring more powerful node hardware, using a leader-driven pipelining of transactions, and filtering and compressing data (like using a form of Proof of History as a timestamping mechanism to streamline consensus)

The trade-off is potential centralization (fewer people can run such high-performance nodes) and sometimes stability issues (Solana has experienced a few outages under heavy load). Other chains use DAG (directed acyclic graph) structures instead of single chain (e.g., IOTA’s Tangle, Fantom’s Lachesis protocol) to allow asynchronous transaction processing. These can, in theory, scale better with network growth, but often require a somewhat centralized coordinator or have not yet demonstrated the same level of security as traditional chains.

- On-Chain Efficiency Improvements: Techniques like segregated witness (SegWit) in Bitcoin or transaction signature aggregation (using Schnorr signatures or BLS signatures to combine multiple signatures into one) reduce the data size per transaction, effectively squeezing more throughput within existing block size limits

Ethereum’s recent switch to Proof of Stake and its introduction of data shards (proto-danksharding, EIP-4844 with “blob” transactions for rollups) are steps to increase capacity for layer-2 data, thus scaling the overall system.

- Hardware and bandwidth growth: Over time, typical node hardware and internet speeds improve, allowing blockchains to cautiously raise block size or frequency without losing decentralization. Bitcoin, for instance, has kept block weight (post-SegWit) fairly constant, but other networks have increased capacity as more nodes on average can handle it. However, leaning too much on this (vertical scaling) risks leaving slower participants behind, and requires continuous re-evaluation.

Despite all these efforts, no public blockchain has yet achieved Visa-level throughput with the full degree of decentralization of Bitcoin or Ethereum. Scalability remains a work in progress. The acceptance of layer-2 solutions indicates a shift: instead of forcing all transactions on the base layer, the community is adopting a hierarchical approach (base layer for settlement, upper layers for activity) – analogous to how not every packet on the internet goes through a single router. This layered model is likely the path forward for scaling. But it introduces new complexity (multiple layers, bridges, potential security issues on those layers) and is still in development.

Privacy and Confidentiality

While blockchains provide transparency and auditability, this is a double-edged sword. On public blockchains like Ethereum or Bitcoin, all transaction details are exposed to the world (with pseudonymous addresses). For certain applications, this level of transparency is unacceptable. Individuals and businesses often require privacy: financial transactions ideally should not reveal amounts and counterparties to competitors or unrelated third parties; healthcare or personal data on a ledger should remain confidential to preserve patient privacy; enterprises using a consortium blockchain might not want to expose their trade data to even other consortium members beyond what’s necessary.

Key privacy challenges:

- On a public blockchain, even though users are pseudonymous (addresses not directly linked to real identity on-chain), advanced analytics can de-anonymize many users. Blockchain analysis firms have become very effective at clustering addresses and tracing flows, meaning the myth of Bitcoin being totally anonymous is false – it’s actually quite traceable

This raises concerns for personal privacy and also can deter businesses from using public chains for sensitive transactions (e.g., a company wouldn’t want all suppliers to see it paid a certain invoice, revealing pricing).

- Lack of privacy can also lead to fungibility issues. If coins can be tainted by their history (for example, coins that passed through a known illicit address might be shunned by exchanges), then each coin is not equal – which undermines the fungibility vital to a currency. Privacy features can help restore fungibility by obscuring which coins came from where.

- Compliance and privacy laws: In permissioned blockchains, sharing data across organizations must still respect regulations like GDPR (as discussed, “right to erasure” vs immutable ledger). Designs have to allow selective hiding or deletion (which is tricky). For public chains, GDPR can conflict if personal data is on-chain.

- Users often resort to off-chain methods (like mixing services or privacy coins) to gain privacy, but these have drawn regulatory ire and sometimes have usability issues (e.g., low liquidity or high technical barrier).

Privacy solutions under development:

- Privacy Coins & Protocols: Coins like Monero, Zcash, and others are built with privacy at their core. Monero uses ring signatures, stealth addresses, and confidential transactions (RingCT) to hide sender, receiver, and amount

Zcash uses zk-SNARKs to allow fully shielded transactions that hide all details except that a transaction occurred (Zcash also has a transparent mode, but fully shielded ZEC is highly private). These technologies demonstrate that on-chain privacy is technically feasible. However, uptake beyond niche communities is limited, partly due to regulatory delistings and also performance – zk-SNARKs historically required heavy computation, though that’s improving. Also, these coins face the challenge that if only a minority use privacy features, those transactions can still stand out (e.g., if 95% of Zcash use is transparent, the 5% shielded are obviously suspicious simply for being shielded).

- Layer-2 and Mixers: On platforms like Ethereum, users can achieve some privacy by using mixers/tumblers (e.g., Tornado Cash allowed users to deposit ETH and withdraw to a new address, breaking the on-chain link). Tornado Cash used zk-SNARKs to improve anonymity (the smart contract doesn’t know which deposit is being withdrawn) and became quite popular for personal privacy. However, as noted, it was sanctioned by the U.S. Treasury for also being used by bad actors

Decentralized alternatives or relayer networks are likely to crop up, perhaps with built-in compliance filters to appease regulators. There are also Bitcoin CoinJoin tools where users coordinate via an external server to shuffle UTXOs, and Lightning Network, which by taking transactions off-chain adds a layer of privacy (channel transactions are private except for opening/closing on chain).

- Zero-Knowledge Proofs: This is a breakthrough technology bringing privacy to public ledgers. Zero-knowledge proofs (ZKPs) allow one party to prove to others that a statement is true (e.g., “this transaction is valid according to the rules and the sender has sufficient balance”) without revealing the underlying information (amounts, addresses, etc.). ZKPs are used in Zcash as mentioned, and now are being generalized. Projects like zkSync and StarkNet (layer-2s on Ethereum) use ZKPs for scaling but could also leverage them for privacy. There’s research into zk-STARKs for completely private smart contract execution, so one could have an entire program running where inputs and outputs are encrypted but a proof certifies that correct execution occurred

This could enable things like confidential auctions on a public blockchain (everyone sees a proof the auction was fair and final price, but not the losing bids).

- Confidential Computing and Trusted Execution Enclaves: Some projects (e.g., Hyperledger Avalon, or secret network) explore using hardware-based secure enclaves (like Intel SGX) where transactions can be processed in an encrypted form and only the enclave outputs a hash or proof to the chain. This way, even validators don’t see the actual data in plaintext. Secret Network (a Cosmos-based chain) implements smart contracts where data within a contract is hidden from node operators via enclaves, but outputs certain agreed-upon info. This provides privacy at the contract level, though trust is partially placed in hardware security assumptions.

- Permissioned Chain Privacy: In consortium chains like Hyperledger Fabric or Corda, privacy is achieved by design: data is shared only on a need-to-know basis. Fabric has private data collections (where a subset of orgs share certain data off-chain and only a hash goes on-chain), and channels (separate ledgers for separate groups of members). Corda operates on a flow model: a transaction is only gossiped to the nodes that are parties to it (no global broadcast). These architectures sacrifice some decentralization (not every node validates every transaction) for confidentiality – but they are suitable when participants are known and legal agreements substitute for global consensus. In such setups, privacy is less of a technical hurdle (it’s built in), but interoperability between silos becomes an issue (hence tools to bridge networks or selectively share records).

- Regulatory and Best Practices: Some proposed standards aim to incorporate privacy by design. For instance, the idea of Selective Transparency – default transactions could be shielded, and authorized regulators could view details through a controlled mechanism (like a “viewing key” given to regulators under certain conditions or a group of compliance validators who can collectively approve revealing data if a court order is presented). This is complex to get right, but it could allow privacy for users while still enabling law enforcement to do targeted investigations (as opposed to mass surveillance). We may see hybrid systems where 99% of data is private but users or exchanges can opt-in to share certain data with authorities under predefined circumstances.

Privacy vs. Auditability trade-off: One beauty of blockchain is auditability – anyone can verify the state and history. Strong privacy techniques complicate that, because if amounts are hidden, how do you audit that no more coins were created out of thin air? Solutions exist (Zcash’s math ensures total balance integrity, and some advanced ZKP-based accounting can allow audits without revealing individual data). But it adds complexity and trust in advanced cryptography. Also, fully private transactions make compliance monitoring harder – hence the tug-of-war with regulators.

Currently, lack of privacy is one major reason enterprises often opt for permissioned or private chains for sensitive workflows. It’s also why some financial institutions have hesitated to use public chains for things like securities trading – they don’t want competitors seeing their trades or positions. Solving this could unlock huge use cases, from confidential business contracts on public networks to personal data markets where individuals sell their data but keep anonymity.

In sum, privacy is both a demand (for usability and compliance with privacy laws) and a challenge (to implement without undermining security or regulatory objectives). Ongoing innovations in cryptography are promising: zero-knowledge proofs and other privacy-preserving tech are emerging as the keys to reconciling blockchain transparency with data confidentiality

We can expect next-generation blockchains to have privacy features baked in at the protocol level. Until then, users and businesses must choose between transparent chains (with creative off-chain workarounds for privacy) or private ledgers that trade off some decentralization for confidentiality.

User Experience (UX) and Usability

For the average user, interacting with blockchain-based systems today can be intimidating and error-prone. Poor user experience is a significant barrier to mainstream adoption:

- Managing Private Keys: The concept of owning a secret 12- or 24-word seed phrase that controls one’s funds is fundamentally different from familiar account/password recovery models. If a user loses their private key (or seed phrase) or accidentally deletes their wallet, their assets are irretrievable – there’s no “Forgot my password” option. Conversely, if someone else gets hold of the key, they have full control to steal funds. This puts a huge responsibility on non-technical users, and many have suffered losses due to lost keys, stolen keys (phishing attacks, malware), or simple mistakes. Key management and security is arguably the number-one UX challenge: it’s both a technical and psychological hurdle (users must take on a custodial role that banks normally fill). Solutions like hardware wallets mitigate risks but add cost and complexity; custodial wallets (letting an exchange or service hold keys) improve convenience but reintroduce central trust and single points of failure (and indeed many users lose money when exchanges get hacked or collapse).

- Complex Addresses and Interfaces: Blockchain addresses are long hex strings (e.g., 0x3F2e…4B9C) – not human-friendly. Sending funds to the wrong address (by a slip of a character) can mean irreversible loss. This contrasts with, say, typing an email address or selecting a contact name – very forgiving systems by comparison. Efforts like the Ethereum Name Service (ENS) map short names to addresses, and similar domain-like systems (DNS-like) exist on other chains to improve this

Those help, but adoption is still emerging and not universal. Likewise, transaction data like gas fees, nonce, UTXOs, etc., are arcane concepts exposed to users in many wallet UIs. For instance, Ethereum users have to set gas prices; if they set too low, their transaction stalls, too high and they overpay. Though wallets now often auto-suggest fees, during volatile times users might need manual tweaks. This is not a user-friendly experience compared to swiping a credit card (where fees are invisible to the user, just embedded in prices).

- Delayed or Uncertain Finality: In a blockchain, when you send a transaction, you often have to wait for confirmations. New users may not understand why their transaction is “pending” or what a confirmation means. If the network is congested (as often happens on Ethereum), a transaction might be stuck for hours unless one knows how to replace it with a higher fee (and average users do not know that). This can lead to confusion (“Did my payment go through or not?”). Instant finality is the norm in web2 apps (when you send a message or make a database update, it’s effectively instant from user perspective). Achieving that experience on a decentralized network is hard. Newer chains or layer-2 solutions aim for sub-second confirmations, but with main nets it’s still an issue.

- Difficult Recovery and Customer Support: Because blockchain transactions are irreversible, user errors (like sending money to the wrong person or smart contract) can’t be rolled back. In the traditional system, if you transfer money to the wrong bank account, you can often appeal to the bank to reverse it. In crypto, unless you can get the recipient to voluntarily refund you, you’re out of luck. Similarly, decentralized apps typically have no customer support hotline. For non-technical users, this is daunting. Some emerging services offer “decentralized support” via community DAOs or insurance funds, but these are nascent.

- Learning Curve and Terminology: Concepts like mining, halving, staking, slashing, liquidity pools, impermanent loss, hash rate, consensus – these are specialized terms that new users find baffling. The industry is creating more user-friendly abstractions (for example, some wallets hide technical details under simple “Fast / Normal / Slow” transaction speed settings, rather than asking for specific gas values), but generally using crypto often requires learning new mental models. This is a barrier especially for older or non-tech-savvy people. Imagine asking a casual user to navigate Uniswap to swap tokens: they must understand wallets, connect wallet, possibly adjust slippage tolerance, confirm a transaction in MetaMask, then wait and add a token contract address to see the new token in their wallet. That’s a lot of steps compared to, say, using a currency exchange on a banking app.

- Security Worries for Users: The user experience is also marred by constant security warnings – and rightly so, because phishing and scams are rampant. Users have to be on guard against fake wallet apps, phishing sites that mimic real DeFi dApps, or malicious smart contracts. There’s no regulated safeguard or fraud refund (unlike credit cards where fraudulent charges can be reversed). This can make the experience stressful for users, always checking, “Is this the correct site? Is my computer secure? Did I copy the right address?” Reducing that cognitive load is key to mainstream adoption. Services like hardware wallets and multi-signature schemes improve safety (a hardware wallet won’t sign a transaction to an unknown contract without user confirmation on device), but they add steps to the UX.

- Platform Fragmentation: Another UX challenge is that the blockchain ecosystem is fragmented across many chains and layer-2s. A user might have some assets on Ethereum, some on BSC, some on Solana, etc., each with different wallet software or at least different networks to switch to. Managing multiple wallets or multi-chain interactions (bridging assets from one chain to another) can be confusing and risky (bridge hacks aside, even just using bridges requires understanding wrapping tokens, etc.). Efforts are underway to unify UX – e.g., wallets that handle multiple chains under the hood, showing assets in one interface – but fragmentation remains an issue.

- Scaling-related UX issues: As noted, when networks congest, fees spike – this directly hits user experience (imagine trying to buy a $5 coffee with crypto and paying a $20 fee – obviously unacceptable). Layer-2 can make fees negligible, but then user must know how to use layer-2, etc. As scalability improves, these pain points should diminish.

Improving the UX: The blockchain community is acutely aware that early crypto UX is akin to the early Internet (when users had to type arcane commands or suffer through clunky dial-up processes). We’re now seeing:

- User-friendly wallets: Mobile wallets with familiar sign-in methods (biometric or PIN login instead of re-entering seed), integration of backup key solutions (social recovery where friends or a service can help restore a lost seed by reconstructing it from shards, and use of hardware secure enclaves for key storage to make it more foolproof. Smart-contract wallets (like Argent on Ethereum) allow features like setting daily transfer limits, whitelisting trusted addresses, or assigning “guardians” who can approve recovery – similar to how a bank account might have safeguards, but implemented in a decentralized way.

- Human-readable names: Projects like Ethereum Name Service (ENS) and Unstoppable Domains provide blockchain DNS solutions where you can send funds to alice.eth instead of a long address

Many wallets now natively support ENS resolution. In the future, you might not even see addresses; your wallet might automatically show your contacts by a nickname (resolving to their address via a service under the hood).

- Integrated Experiences: Exchanges and fintech apps are increasingly abstracting blockchain complexity. For instance, PayPal and Revolut allow users to “buy Bitcoin” through a slick interface (though initially custodial – which sacrifices decentralization but improves UX). Some wallets let users buy crypto with a credit card or bank transfer inside the app, removing the need to go to an external exchange first. The line between centralized and decentralized is blurring in UI: e.g., certain wallets integrate a DEX aggregator but present it almost like a normal exchange interface, making trading tokens feel simpler.

- Faster confirmations: New chains and layer-2 networks that confirm transactions in under a second provide a user experience akin to web2 apps. As these become more common, users won’t have to stare at a “pending…” spinner for long. Also, techniques like transaction cancellation or replacement are being made more accessible (some wallets let you cancel a stuck Ethereum transaction by sending a 0 ETH tx with same nonce and higher gas, through a button press, whereas previously one had to know the arcane procedure).

- Education and UX writing: Good apps are improving the wording and design around crypto actions. For example, instead of “Broadcasting to mempool” a wallet might say “Transaction submitted…waiting for confirmation.” Tooltips, tutorials, and safety warnings (with clear instructions, not just geek-speak) are becoming standard. The learning curve is gradually being addressed with better documentation and in-app guidance. Some wallets have “beginner mode” vs “expert mode” toggles.

- Custody vs Control trade-off: Many users frankly do not want to manage keys. We may see solutions like multi-party computation (MPC) wallets which split keys among multiple servers so that no single point of failure exists but the user doesn’t have to hold the full key either. This can allow password-based access with bank-grade recovery, without an actual centralized custodian holding the whole private key. Such solutions (offered by some startups) aim to give a user experience similar to a bank app while still being non-custodial under the hood.

- Regulatory protection: As regulation sets in (as discussed in section 10), users might gain confidence that exchanges or services are supervised and must meet certain operational standards, making them feel more secure in using those platforms. For example, if an exchange is known to be licensed and insured, a user may prefer to use its easy interface and trust it not to disappear, rather than interfacing directly with a DeFi protocol that they find confusing and risky. This could lead to a dichotomy: highly user-friendly experiences possibly coming from semi-centralized entities (with regulatory oversight), whereas pure decentralized use remains a bit more complex. Over time, though, even decentralized interfaces might match that ease as technology matures.

User experience is often cited as the biggest hurdle for blockchain mass adoption now that the technology itself has proven useful. The general public will not use a technology that is error-prone or requires specialized knowledge. The good news is that we’ve been here before – early Internet required manual IP entry, early mobile phones had clunky UIs – and iterative innovation solved it. Likewise, we expect that in the next few years, using blockchain-based applications may become nearly indistinguishable from today’s apps. For instance, a decentralized social media app might have a familiar feed and like button; behind the scenes, your likes might be logged to a blockchain, but you as a user don’t need to know that. Invisible crypto – where the complexity is under the hood – is likely the end-game for mainstream-friendly UX.

In summary, improving blockchain UX means making security and decentralization seamless for users. This involves better key management solutions, friendlier interfaces (no scary hex codes), quick and predictable transaction processing, and robust but simple recovery options. It’s a challenge that is actively being worked on, and each year brings progress (e.g., the rise of smartphone wallets, ENS names, and Layer-2 gas abstractions). Overcoming this challenge is crucial: it will determine whether blockchain remains niche or becomes an everyday infrastructure that people use without a second thought, just as most people drive cars without understanding the engine. The less users have to think about blockchain’s mechanics, the more they can focus on the value it provides – and that is when adoption will soar.

Interoperability (Cross-Chain Compatibility)

The blockchain ecosystem is highly fragmented. Dozens of independent networks exist – Bitcoin, Ethereum, BNB Chain, Solana, Polygon, Avalanche, Cardano, Algorand, Cosmos, Polkadot, Hyperledger Fabric networks, Corda networks, and many more – each with their own protocols, smart contract languages, and security assumptions. Interoperability refers to the ability of different blockchains to communicate, share data, and transfer value with one another. Right now, most blockchains operate in silos, which is akin to the early Internet when networks were isolated before common protocols linked them.

Challenges due to lack of interoperability:

- Siloed Liquidity and Assets: If you hold BTC on the Bitcoin network and want to use it in an Ethereum DeFi application, you can’t directly – you typically must go through a cumbersome process like using a custodial peg (Wrapped BTC) or a cross-chain bridge. Similarly, a game item token on one chain can’t be moved to a marketplace on another chain without some intermediary solution. This fragmentation means users must juggle multiple wallets and often move assets across chains, incurring friction, delay, and fees (and risk, as many cross-chain bridges have been hacked due to their complexity or centralization).

- Multiple Standards: Smart contracts and tokens on different chains follow different standards. For example, Ethereum’s ERC-20 tokens are not natively recognized on Solana or Binance Chain, and vice versa. Developers have to write code for each target chain or use middleware. This slows down innovation – a dApp on Ethereum can’t easily “call” a contract on Tezos, for instance, to combine functionality.

- Complicated User Experience: As mentioned, users dealing with multiple chains must understand concepts like wrapped tokens, bridging, switching network RPCs in their wallet, etc. It’s confusing and prone to error (e.g., sending tokens to an address on the wrong chain – the addresses might be formatted similarly, causing mistakes).

- Network Effects Split: Value and user communities can get split across chains, which sometimes leads to lower overall network effects. For example, there might be 100k users on one blockchain’s DeFi ecosystem and 100k on another, rather than 200k on a single unified one where liquidity and utility would be greater. While multiple chains can also mean parallel innovation (a good thing), lack of inter-chain collaboration means these communities can’t easily transact or co-create.

Approaches to interoperability:

- Bridges: The most common current solution is to use cross-chain bridges – services or protocols that lock an asset on Chain A and mint a representation on Chain B. For example, a bridge might lock 1 BTC on the Bitcoin network and issue 1 “BTCB” token on Binance Chain, which can then circulate on Binance Chain as if it were BTC (backed by the locked BTC). When someone wants to redeem, the bridge burns the token and releases the original BTC. Some bridges are centralized (custodial, relying on one or a few entities to hold the funds), others use multi-signature federations, and newer ones use decentralized models with many nodes (sometimes leveraging external validators or even clever contracts and crypto-economic incentives to stay honest). Despite their utility, bridges have been points of failure – more than $1 billion was stolen in 2022 alone from various cross-chain bridges due to vulnerabilities

This highlights how challenging secure interoperability is.

- Atomic Swaps: These are cross-chain exchanges that do not require a third party. Using hash time-locked contracts (HTLCs), two parties can swap assets across chains trustlessly (e.g., trade BTC for LTC directly between their respective chains). Atomic swaps were pioneered around 2017. While conceptually powerful, they’re not widely used by mainstream users due to complexity and the requirement that both chains support the necessary scripting (Bitcoin-like UTXO scripting with time locks). However, they are used under the hood in some decentralized exchange protocols that span multiple UTXO-based chains.

- Interoperability Protocols and Standards: Projects like Cosmos and Polkadot were built with multi-chain in mind. Cosmos provides the Inter-Blockchain Communication (IBC) protocol, a standardized way for independent blockchains (zones) to pass messages (including token transfers) between each other securely.Already, many Cosmos-SDK chains (like Cosmos Hub, Osmosis, Secret Network, etc.) use IBC to allow cross-chain token movement and contract calls. It’s trust-minimized (each chain’s light client is run on the other chain via a module to verify proofs of state changes). Polkadot has its Relay Chain and parachains architecture: all parachains connect to the Relay Chain, which coordinates cross-chain interactions under the shared security of the Relay validators. This makes interoperability native – parachains can send messages to each other through the Relay Chain. Outside these ecosystems, other standards are emerging: for example, ERC-20 token bridges between Ethereum and layer-2 networks like Arbitrum or Optimism are now typically secured by the rollup’s smart contracts; Layer-0 networks like WAN or Quant aim to connect different chains via overlay protocols.

- Enterprise Interop: In the permissioned world, interoperability issues also exist (a Fabric network and a Corda network can’t directly talk). Efforts like the Hyperledger Cactus project (now Hyperledger Weaver) are building integration tools to let enterprise blockchains of different types interoperate (e.g., a transfer on a Corda ledger could trigger an event on a Fabric ledger through a plugin). Standard bodies like ISO are also looking at interoperability standards (ISO 20022, a financial messaging standard, is being mapped for blockchain transactions by some groups, enabling blockchain networks to plug into the traditional financial messaging networks more seamlessly).

- Metaprotocols and Layer-2: Some interoperability is achieved by building meta-layers. For instance, tBTC is a protocol to bring Bitcoin into Ethereum using a decentralized custodian model (involving Ethereum smart contracts and off-chain bonded signers to secure BTC deposits). By using Ethereum as a layer for Bitcoin proxy tokens, it indirectly connects the two ecosystems. Another example is Wrapped tokens issued by reputable entities (like WBTC is an ERC-20 token 100% backed by Bitcoin held by a consortium). While centralized, WBTC enabled Bitcoin liquidity to be used in Ethereum DeFi, effectively bridging those two worlds.

- Universal Wallets and Interfaces: While not interoperability at the protocol level, multi-chain wallets (like Trust Wallet, Exodus, MetaMask with multi-chain support, etc.) and cross-chain DeFi dashboards (which aggregate data from many chains) give a user the feeling of interop by managing assets in one place. They often have integrated swap features that behind the scenes might use bridges or exchanges to move assets across chains when needed (e.g., swapping an ERC-20 for a BEP-20 via a built-in bridge). This at least eases the UX issue of fragmentation.

Open standards and coalitions are likely to drive progress. Much like TCP/IP unified disparate networks into the singular Internet, we may see certain protocols (like IBC) adopted beyond their original ecosystem (there’s work on bringing IBC to Ethereum, for example, so Ethereum assets could move to Cosmos chains and back in a trustless way). The Web3 community generally understands that interoperability is key to avoiding a future of many isolated “blockchain intranets.”

It’s worth noting, however, that achieving interoperability without compromising security is extremely difficult. Each chain has its own consensus – to trust a cross-chain message, you either run a light client of the other chain or rely on a set of intermediaries. Light clients can be expensive to run within a smart contract environment (though advancements like succinct proofs – see Mina Protocol or Ethereum’s plans for light client support via SNARKs – may help compress this). So many solutions have introduced new trust assumptions (like a multi-sig governing a bridge).

Those become targets for hackers or points of centralization. The ultimate solution might be cryptographic proofs of one chain’s state embedded in another (like relays or zk-proofs). Ethereum is exploring “Merkle-ized fraud proofs” and “validity proofs” for rollup interoperability; projects like zkBridge aim to use zero-knowledge proofs to verify one chain’s state on another without a central relayer. These are cutting-edge and not fully production-ready in all cases, but could be in the coming years.

From the user perspective, in 5-10 years one would hope that using blockchain applications won’t require awareness of what chain you’re on at all – much like when you send an email, you don’t think about how it routes through different servers. Achieving that likely means heavy-duty interoperability protocols in the background performing cross-chain transfers of assets and data automatically. For example, a future wallet might let a user swap Bitcoin for Ether in one click, and under the hood it performs an atomic cross-chain swap via a decentralized protocol, without the user needing to move funds to an exchange or bridge manually. Or a supply chain network on Fabric might automatically use a public chain’s proof-of-existence service for audit, without the logistics manager needing to interact with two systems.

In summary, interoperability is a current challenge much like connecting disparate computer networks was in the 1980s. It’s being tackled through bridges, cross-chain protocols (like Cosmos IBC and Polkadot XCMP), atomic swaps, and collaborative standards. While progress has been made, numerous high-profile bridge hacks have shown the difficulty of “linking the chains” securely. Overcoming this challenge is critical: it will enable liquidity and users to flow freely to where they’re needed, prevent blockchain balkanization, and fulfill the vision of a unified Internet of Value where value moves as seamlessly as information does on the Internet today.

Energy Consumption and Environmental Impact

One of the most publicized criticisms of blockchain technology, especially proof-of-work based cryptocurrencies, is the high energy consumption and associated carbon footprint. At its peak, the Bitcoin network was estimated to consume on the order of 100–150 TWh of electricity annually – comparable to a mid-sized country’s consumption (roughly the same as Poland or Kazakhstan). This level of energy usage for a financial network processing ~7 transactions per second strikes many as inefficient or unsustainable, particularly in an age where climate change mitigation is paramount.

Why do PoW blockchains consume so much energy?

Proof-of-Work consensus relies on miners expending computational effort (and thus electricity) to solve cryptographic puzzles (hashing) to secure the network. This “work” ensures the integrity of the blockchain – it makes attacks extraordinarily costly because an attacker would need at least 51% of the global hashpower, which in turn means enormous electricity expense. The design deliberately trades off energy for security (making cheating economically irrational). As Bitcoin grew in value, miners invested in more and more hardware and electricity to compete for block rewards, driving up consumption. By design, the difficulty of mining adjusts to keep block times roughly constant, so more miners = more difficulty = more power burned with no increase in throughput. In essence, Proof-of-Work converts electricity into network security.

The environmental concerns are:

- Carbon Emissions: If the electricity used is generated from fossil fuels, the carbon footprint is significant (some estimates put Bitcoin’s CO2 emissions on par with that of a small country’s yearly emissions). This raised alarms that popularizing PoW cryptos could hinder climate goals. Some jurisdictions (like certain provinces in China, and later the entire Chinese government) banned or limited mining partly due to energy strain and emissions. Other places like Iran oscillated in allowing mining due to its impact on their grids.

- E-Waste: Short upgrade cycles for mining equipment (ASICs) lead to a lot of electronic waste as older models become uncompetitive and are scrapped. One study in 2021 noted that Bitcoin mining generated tens of kilotons of e-waste per year, as devices have roughly 1.5-year lifespans on average before replacement.

- Opportunity Cost of Energy: Critics argue the energy could be used for more productive tasks. There’s an ethical question: Is securing a financial network or minting NFTs worth the same energy that might power X number of homes or industrial processes?

- Public Perception and ESG: Many companies are reluctant to engage with PoW-based crypto because of ESG (Environmental, Social, Governance) concerns. Institutional investors with green mandates avoid Bitcoin due to its “dirty” image, which affects adoption as a mainstream asset. Some projects like Chia tried to create “green” consensus (Chia uses Proof-of-Space-and-Time, relying on storage space rather than CPU/GPU cycles – though that has its own resource considerations, like lots of hard disk use).

Responses and improvements:

- The blockchain community is well aware of these issues. The single biggest recent improvement was Ethereum’s switch from Proof-of-Work to Proof-of-Stake in 2022 (the Merge). This reduced Ethereum’s energy usage by ~99.95%, as validating blocks in PoS only requires running a node (equivalent to running a software server) which is magnitudes less power-hungry than running mining rigs. This one change is estimated to have cut global electricity consumption by around 0.2%, a significant chunk. Ethereum’s successful transition proved that a major blockchain can maintain security without PoW’s waste (though it took years of careful development and testing). Other top platforms like BNB Chain, Cardano, Solana, Algorand, Tezos, Avalanche, Polkadot – all have been PoS from the start, so the industry trend has clearly moved toward low-energy consensus for new chains. Essentially, Bitcoin is the only top crypto still on PoW (plus some smaller coins like Litecoin, Monero, etc.).

- Mining’s Energy Mix: Not all mining is equally harmful. A substantial portion of Bitcoin mining is powered by renewable or stranded energy. In fact, miners often seek the cheapest power, which in many regions is renewable (hydro, wind, solar during excess generation) or otherwise wasted energy (like natural gas flared at oil fields). A 2022 report from the Bitcoin Mining Council claimed about 59% of Bitcoin mining energy came from sustainable sources, making Bitcoin one of the “cleaner” industrial uses of energy. This figure is debated, but there’s evidence of large mining operations co-locating with hydroelectric plants in Sichuan (before China’s ban), wind farms in Texas, geothermal in Iceland and El Salvador, and so on. Initiatives like using flared gas (which would have been burned off uselessly) to run generators for Bitcoin mining actually reduce net carbon emissions compared to flaring (since the energy does some work and flaring methane has worse greenhouse effect than its CO2 combustion byproduct). Some see Bitcoin as a buyer of last resort for renewable power, potentially improving economics for renewable projects by soaking up excess supply when demand is low (sunny day, holiday, etc.). These nuances are often lost in the broader debate. Nonetheless, the worst-case image of coal-powered mining farms is also real in some areas (e.g., some miners relocated to regions with cheap coal after China’s ban).

- Regulation and Industry Pledges: Environmental regulations are being considered or enacted. For example, New York State put a moratorium on new fossil-fuel-powered PoW mining operations (existing ones or those using renewables were exempt). The European Union debated (but rejected) a potential PoW ban during MiCA negotiations, opting instead for disclosure requirements about sustainability. Meanwhile, the crypto mining industry is responding with initiatives like the Crypto Climate Accord and Bitcoin Mining Council, aiming for 100% renewable mining in the coming decade. There’s also research into carbon offsetting by protocols – some projects use a small portion of fees or block rewards to automatically purchase carbon credits (making the chain “carbon-neutral”). While offsets are sometimes viewed critically, it’s a gesture toward accountability.

- Proof of Stake and New Consensus Mechanisms: As mentioned, virtually all new blockchains avoid PoW. Even Bitcoin – the bastion of PoW – has adjacent projects exploring energy-friendly alternatives (though consensus in the Bitcoin community for changing PoW is extremely low). Some Bitcoin developers promote ideas like Proof-of-Stake or hybrid models for Bitcoin, but they have little traction given Bitcoin’s philosophy. Instead, Layer-2 solutions like the Lightning Network help by shifting many transactions off the PoW chain, thereby handling more activity without additional PoW cost. Essentially, if Bitcoin can serve as a high-security base layer with relatively fewer transactions (settlement layer), and most small transactions happen on Lightning channels (which use negligible power), the energy per transaction metric (often cited by critics) becomes far less alarming, because one on-chain transaction could net-settle thousands of off-chain transfers.

- Technology Efficiency: Mining hardware has gotten more energy-efficient (more hashes per watt) over time as ASICs improved and moved to smaller semiconductor processes. However, improvements are hitting physical limits and tend to be outpaced by difficulty increases (more miners join as price goes up). In PoS, efficiency gains come from software – running nodes can be done on modest hardware (Ethereum now has validators running on Raspberry Pi’s, for instance). As software clients get optimized, node energy usage can drop. Also, some blockchains are exploring multi-party computation or sharding that could allow nodes to do less redundant work, thus saving energy collectively.

- Perception vs. Reality: It’s worth noting the global context of energy use. Yes, Bitcoin uses a lot of energy, but so do other human activities: global data centers consume ~200 TWh/year (double Bitcoin’s use), global air conditioning ~2,000 TWh, and the global financial system’s energy footprint (data centers, bank branches, ATMs, etc.) is also quite high (some pro-crypto arguments claim Bitcoin might even be more efficient at securing value). That said, any significant energy hog draws scrutiny in a climate-conscious world. The future likely demands that major PoW networks either transition (as Ethereum did) or convincingly use mostly green energy. If they don’t, they could face carbon taxes or bans in certain jurisdictions.

In summary, energy consumption remains a reputational and logistical challenge for blockchain, but the industry is actively addressing it. The shift to Proof-of-Stake by many platforms drastically cuts energy usage and is one of the biggest engineering responses to environmental concerns in tech history. For the remaining PoW systems, pressure is mounting to ensure they use sustainable energy or evolve their consensus. The evolution of mining towards renewables and the possible development of carbon-neutral mining facilities (for instance, miners co-locating with solar farms and only mining when surplus power is available) could further mitigate impact.

From a sustainability standpoint, the trend is cautiously optimistic:

- By 2025, the vast majority of new blockchain transactions (thanks to PoS networks and layer-2s) will likely have a trivial energy cost per transaction.

- Bitcoin and a few others will continue PoW, but potentially with a greener grid and more layer-2 usage making the “energy per transaction” metric less relevant.

- The narrative is shifting from “blockchain = environmental nightmare” to “blockchain is reforming itself to be environmentally responsible.” This shift is crucial for public acceptance and for blockchain to align with global ESG goals.

In conclusion for current challenges: Scalability, privacy, UX, interoperability, and energy use are the primary hurdles blockchains face today. These challenges are widely recognized, and a tremendous amount of talent and resources in the blockchain community are dedicated to overcoming them:

- Scalability through layer-2s and next-gen protocols (without sacrificing security/decentralization).

- Privacy through advanced cryptography and hybrid designs.

- Usability through better product design, key management solutions, and education.

- Interoperability through cross-chain protocols and standards that knit together the patchwork of networks.

- Energy reduction through consensus innovation and greener mining practices.

Solving these is essential for blockchains to move from the margins towards mainstream infrastructure. The progress, especially in the last couple of years (e.g., Ethereum’s PoS upgrade, rollup deployments, UX-focused wallets, etc.), shows that the ecosystem is capable of rapid improvement. While challenges remain, the trajectory suggests that many of these current limitations will be mitigated or even largely solved in the coming years, ushering in a more scalable, user-friendly, interconnected, and sustainable blockchain ecosystem.

Layer 2 Solutions: Rollups, Channels, and Sidechains

To address the scalability and cost issues discussed above, the blockchain community has developed Layer 2 solutions – frameworks that operate on top of the main blockchain (Layer 1) to handle transactions more efficiently, while still relying on Layer 1 for security and final settlement. In simpler terms, layer 2s move the bulk of transaction processing off the main chain, reducing load on Layer 1, but periodically anchor results back to it. This allows many more transactions to occur, often at near-zero fees, without changing the fundamental Layer 1 protocol.

The major Layer 2 approaches include state channels, sidechains, and rollups (both optimistic and zk-rollups). Each works differently, but all aim to increase throughput and reduce latency/costs while preserving the trust model of the underlying blockchain.

State Channels (Payment Channels)