In today’s digital age, where online transactions have become the norm, payment gateways serve as the backbone of financial interactions between businesses and consumers. Whether you’re running an e-commerce platform or managing a streaming service, choosing the right payment gateway is crucial for the success of your business. In this comprehensive guide, we’ll delve into the various types of payment gateways, their features, and the factors you need to consider to make informed decisions.

A payment gateway is what keeps the payments ecosystem functioning seamlessly, as it enables merchants to accept payments online or transfer funds between consumers and businesses. If you’re an online merchant, it’s important to understand at least the basics of how an online payment flows from your customer to your bank account.

Integrates with the merchant’s business bank account

A payment gateway provides a business with one or more ways to integrate online debit and debit card payments and card processing capabilities with the merchant business account.

Records payment details for customer transactions

Via processes provided by a payment gateway provider, the merchant then sends their customer’s safely encrypted information to the payment gateway

Routes information to a payment processor or an acquiring bank

The merchant’s acquiring bank then takes the next step, carrying out fraud checks, then sending the transaction to the card networks.

Notification of approval or decline

The payment gateway informs the merchant of confirmation or rejection of the payment. If the payment is declined, the merchant may ask for another form of payment.

The benefits of using a payment gateway

The best payment gateway systems, and good payment gateway providers will fit seamlessly into the day to day operations of a business, offering integrated payment by debit and credit cards, and processing payments with ease. Some of the main benefits of payment gateways include:

Speed of the payment process

Fast, efficient online payment gateways are a vital aspect of digital transactions and to receive debit and credit card payments for any merchant account. One of the traits of online shopping is impulse buying, so it’s important to capture the purchase in the moment by ensuring your customers don’t experience delays anywhere in the payment process. Speedy transactions when accepting payments could make the difference between a sale and an abandoned shopping cart.

Convenience and confidence

E-commerce is a global market. With the right payment gateway, customers can shop and make payments anytime and anywhere, while merchants can easily accept payments. Technologies like payment gateways allow people to feel increasingly more confident with online purchases, and this gives them the freedom to source the best or cheapest products, regardless of location.

Expanded customer base

The right payment gateways enable shoppers from anywhere in the world to have access to your store. This access to international transactions gives businesses the opportunity to experience potentially limitless growth and expansion of their customer base. Depending on business needs, affiliate marketing partnerships can be an additional feature of many payment gateways to help funnel more leads to your business.

Secure Transactions

With a payment gateway, all payment information is heavily encrypted to ensure that data is protected. This will help your business meet GDPR and industry-standard requirements such as the PCI DSS compliance (Payment Card Industry Data Security Standard). Secure payment transactions protect the customer and an online business from potential fraud.

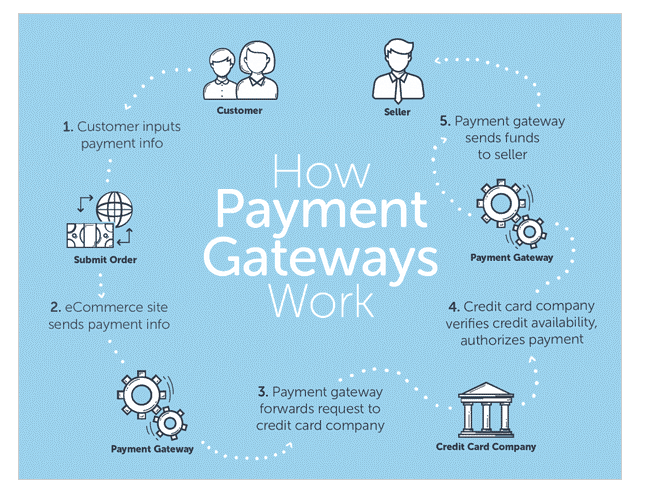

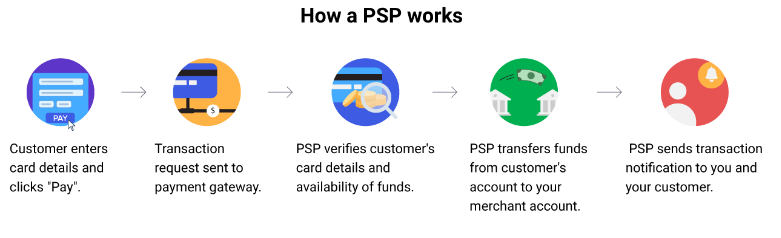

The moving parts of a payment gateway

It might look complex, but with a payment gateway, the whole process takes just a few seconds, and as technology continues to evolve, the process becomes even faster.

A payments gateway ensures a simplified process on the front-end, meaning that customers don’t have to go through complicated procedures in an online store to complete transactions. For instance, if the customer is processing the credit card payment online by themselves, they can enter the card details online, or make their payments with Apple Pay, Google Pay, or any digital wallet, and in a few seconds they’ll know if their payments have been successful.

Merchant accounts explained

Not to be confused with business bank accounts, a merchant account is a specific bank account required for credit card payments, and online trading for any business owner.

Payment gateways, payment service providers (PSP’s), a merchant acquiring bank, payment processors, independent sales organizations (ISOs) or high street banks can provide you with a merchant account.

Once approved, a merchant identification number (MID) is assigned, and this is required to process debit and credit card transactions and to move funds from customer issuing banks to a merchant’s business bank account, once payments are authorized and ready to be settled.

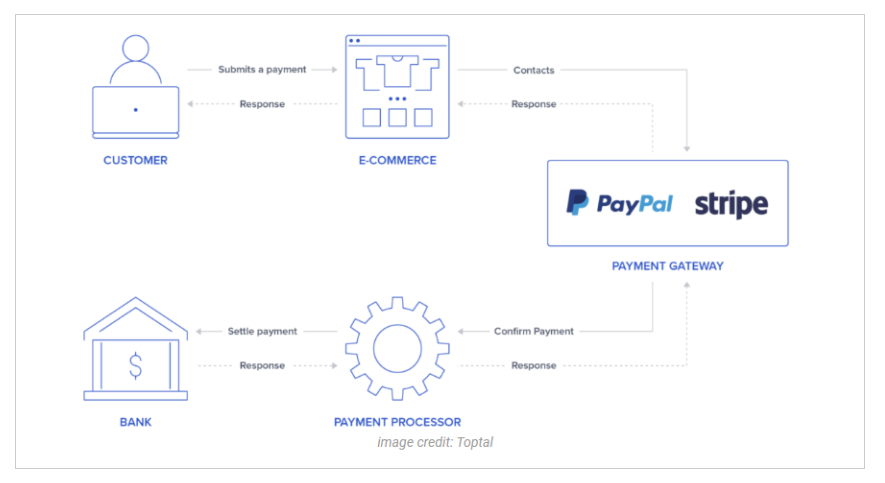

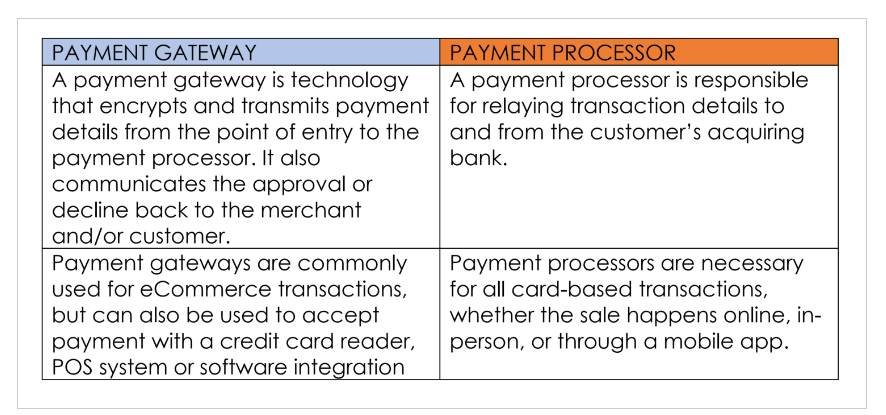

Payment gateways vs Payment processors

An online business needs to have a payment gateway in place to accept credit card payments, as well as other alternative payment methods or payment cards that their customers might prefer. When an online purchase is made, the payment gateway transfers the transaction data and approves or declines the payment. However, it does not deal with the processing of the payment itself. This is where the payment processor comes in.

The payment processor interfaces with the customer’s card network (e.g, Visa, Mastercard), which then routes the transaction to the issuing bank (the bank that issued the credit card to the customer). The issuing bank verifies that there are funds available in the customer’s account to cover the purchase amount.

Different types of payment gateways

Depending on the size of a business, different needs budgets and preferences, there are a variety of payment gateway types to choose from. These are some of the most common:

Hosted payment gateways (Redirects)

Hosted payment gateways or ‘redirects’ normally involve sending customers to another site to process payment. One of the most common examples is PayPal, which is easy to set up and many small businesses rely on this form of payment.

While sometimes described as a payment provider, PayPal provides similar services to both a payment gateway and a payment processor. Large businesses also offer PayPal as an option because of its immense popularity. Since PayPal offers merchants and customers the ability to set up recurring payments, this becomes a good option for some companies.

Checkout onsite, payment offsite

In this case, the checkout, or processing is done on the merchant’s site but final payment is done on a redirect site such as Stripe. Much like the redirect option, this offers simplicity but limited customization of the user experience.

Customizable onsite payment gateways

Onsite payments are generally for larger enterprises with the resources to handle the added complexity. This essentially means that all payment and processing is done through the company’s own server,

The idea of a single gateway seems smart to many new business owners because it simplifies the process. Having multiple gateways actually offers advantages that help make your business more profitable, but could be more costly in the end.

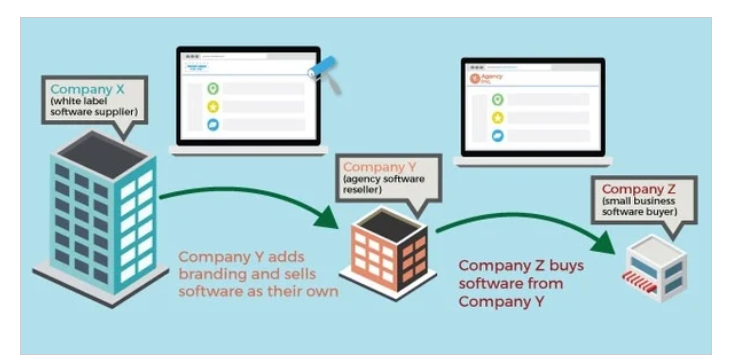

What is a white label gateway?

Some payment gateways offer white label services to online businesses. A white label payment gateway is a payment gateway system that allows a business owner or a brand to process online payments using their official name while using third-party services. In other words, a company puts its logo on the customized solution.

Payment gateway vs Payment Service Provider (PSP)

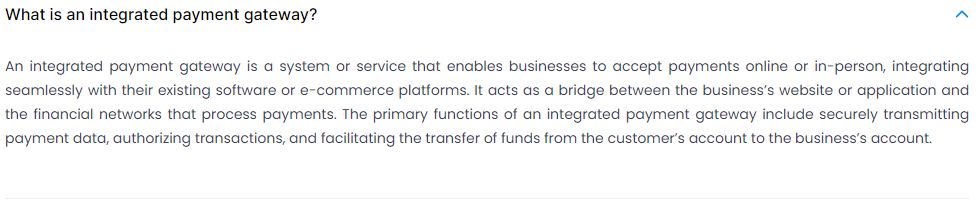

Payment service providers – also known as merchant service providers – are third parties that help merchants accept credit cards, or receive payments by debit card, or other payment methods like bank transfers, real time payments etc.

What is a Payment Gateway and Why is it needed for businesses?

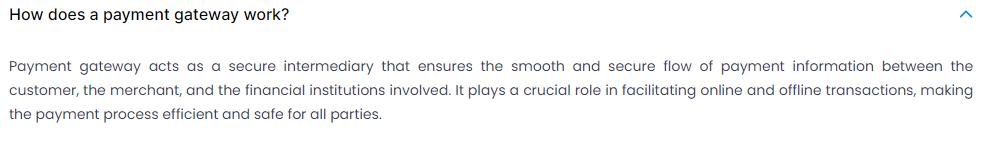

Payment gateways act as intermediaries between customers and merchants, facilitating secure online transactions. They play a pivotal role in the e-commerce ecosystem by authorizing and processing payments, ensuring seamless financial interactions. For streaming services, payment gateways enable the monetization of content through subscription models, pay-per-view, and advertising revenue.

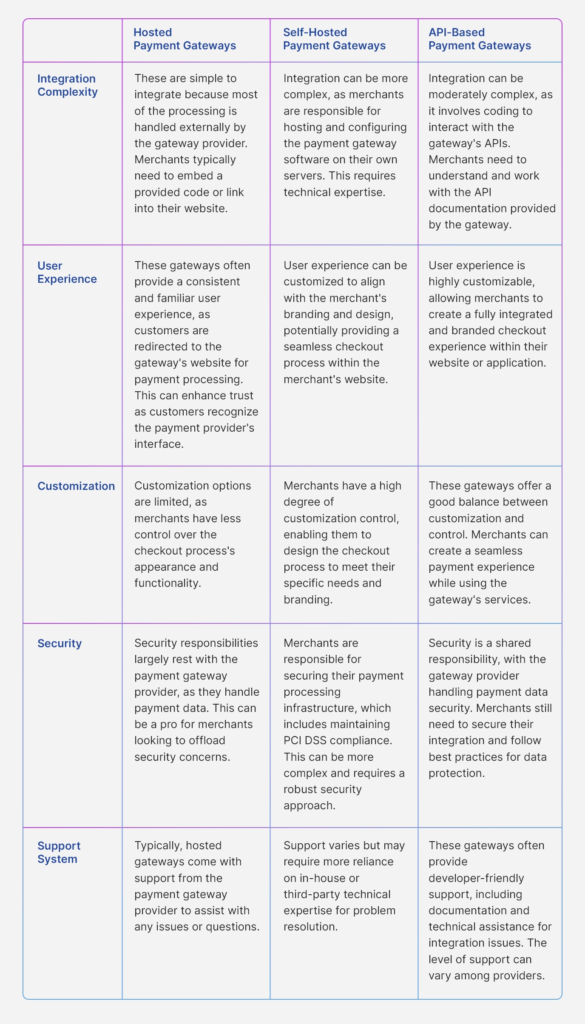

Types of Payment Gateways

Hosted Payment Gateways:

Hosted payment gateways, such as PayPal Standard and Stripe Checkout, handle the entire payment process externally. Customers are redirected to the gateway’s website for transaction completion, offering simplicity and security. However, customization options may be limited, and transaction fees are common.

Self-Hosted Payment Gateways:

Self-hosted solutions, like WooCommerce with various plugins, provide merchants with more control over the payment process. While offering customization and potentially lower transaction costs, they require technical expertise for setup and maintenance.

API-Based Payment Gateways:

API-based gateways, such as Braintree and Authorize.Net, offer a balance of customization and control. Merchants can integrate payment processing into their websites or applications using APIs, ensuring a seamless payment experience while outsourcing security and compliance.

Local Bank Integration:

Local bank payment gateways, like iDEAL and GiroPay, cater to regions where customers prefer bank transfers over credit cards. While offering lower transaction fees and supporting local payment methods, they may lack international support and pose integration challenges.

Importance of Payment Gateway in E-commerce and Online Transactions

- Security: Payment gateways ensure the confidentiality of financial information through encryption and security measures.

- Fraud Prevention: Built-in fraud detection tools identify and prevent suspicious transactions, safeguarding both customers and merchants.

- Global Reach: Payment gateways enable businesses to accept payments from customers worldwide, supporting various currencies and payment methods.

- Convenience: Offering multiple payment options enhances the customer experience, encouraging more transactions.

- Payment Processing: Gateways streamline the flow of funds, ensuring prompt settlement for merchants.

- Multiple Currencies: Support for multiple currencies facilitates international transactions, catering to a diverse customer base.

- Real-Time Transactions: Immediate confirmation of transactions builds trust and improves inventory management.

Integration of a New Payment Gateway in Muvi – Factors to take into Consideration

Integrating a payment gateway into Muvi, a platform for OTT and video streaming services, requires careful consideration of various factors:

- Settlement/Processing Country/Currency: Ensure compatibility with the target audience’s location and preferred currency.

- Payment Methods: Support popular payment methods to cater to diverse customer preferences.

- Monetization Model: Adapt payment processing to subscription or pay-per-view models.

- Integration: Choose between API and webhook integration for seamless interaction with Muvi’s backend.

- Promotional Features like Coupons: Implement discount mechanisms to attract and retain customers.

In conclusion, understanding the nuances of different payment gateways is essential for optimizing financial transactions and enhancing the customer experience in today’s digital landscape. By leveraging the right payment gateway for your business needs, you can unlock new opportunities for growth and success.