Introduction:

Tether (USDT) is the world’s most widely used stablecoin, serving as a bridge between traditional finance and the crypto ecosystem. Pegged 1:1 to the U.S. dollar, USDT allows fintech and payments professionals to move value quickly on blockchain networks without the volatility of typical cryptocurrencies.As of mid-2025, Tether represents over 60% of the stablecoin market and regularly exceeds even Bitcoin in daily trading volume.

This deep-dive will explore Tether’s technical architecture and product design in a whitepaper-style format. We will examine how Tether’s blockchain contracts work (focusing on Ethereum and Tron implementations), the off-chain reserve mechanism that backs the token, governance features like blacklisting and pausing, and the economic model that sustains USDT.Comparisons with other stablecoins (USDC, DAI, and algorithmic designs) will highlight the unique pros and cons of Tether’s approach.

The goal is an accessible yet technical explanation, aimed at professionals with moderate blockchain knowledge, of how Tether works under the hood and why certain design choices were made.

Tether’s Technical Architecture

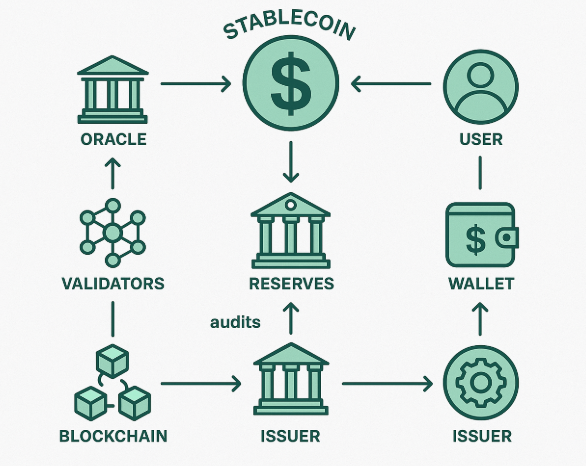

Tether’s architecture spans both on-chain and off-chain components to maintain a stable, redeemable USD-pegged token.

On the blockchain layer, USDT exists as tokens on multiple networks – originally on Bitcoin’s Omni Layer, then on Ethereum as an ERC-20 token, and later on high-throughput chains like Tron, Solana, Algorand, and others. Each USDT token on any chain is backed by an equivalent U.S. dollar reserve held by Tether Ltd off-chain. The smart contract layer defines the token’s logic (balance tracking, transfers, permissions) on each blockchain. Finally, off-chain reserve management involves the banking and treasury operations that ensure every USDT in circulation is matched by assets in Tether’s reserve.

Below we break down these layers and how they interoperate:

Multi-Chain Deployment and Blockchain Layer

From a product perspective, Tether’s decision to deploy USDT on multiple chains was driven by scalability and accessibility. Ethereum was one of the first popular platforms for USDT (launched as an ERC-20 token in late 2017), offering integration with the booming Ethereum ecosystem (exchanges, wallets, DeFi). However, as Ethereum usage grew, network congestion and high gas fees made everyday USDT transactions expensive.

Tether responded by expanding to other networks. In 2019, Tether partnered with Tron to launch USDT as a TRC-20 token on the Tron blockchain. Tron’s network provides fast 3-second block times and negligible fees, making it attractive for high-volume and retail transactions. By 2025, Tron actually surpassed Ethereum in total USDT circulating supply, hosting about $75+ billion USDT (over 50% of all USDT) while Ethereum hosted about $72 billion. This shift reflects user preference for Tron’s low-cost, quick transfers, especially in emerging markets where USDT is used for day-to-day payments. Ethereum’s USDT remains crucial for integration with decentralized finance (DeFi) protocols and as a base currency on many exchanges, but Tron has become the rails for cheap, high-speed value transfer.

Each blockchain hosting USDT has its own smart contract for the token, but Tether strives to keep the token behavior consistent across chains. Both the Ethereum (ERC-20) and Tron (TRC-20) implementations have 6 decimal places (unlike Ethereum’s typical 18 for tokens), reflecting Tether’s legacy design choice (1 USDT = 10^6 in smallest units) to mirror the 1 cent precision of traditional finance.

On both chains, new tokens can only be minted by Tether’s authorized accounts, and special admin controls (freeze, etc.) exist as we’ll detail. A notable historical quirk is that the Ethereum USDT contract deviated slightly from the ERC-20 standard: it did not return boolean success values from transfer / transferFrom calls, which has caused integration issues unless handled specially. Newer USDT implementations on other chains have “fixed” this by following the standard return conventions, but on Ethereum, smart contracts using USDT often need to use libraries like SafeERC20 or custom interfaces to accommodate the non-standard behavior.

Aside from such nuances, USDT’s core logic is similar on Ethereum and Tron, as both are account-based blockchains and Tron’s TRC-20 standard closely mirrors ERC-20.

Smart Contract Design and Modules

The USDT token contract on Ethereum is implemented in Solidity (version 0.4.17) and follows an object-oriented structure by inheriting several modules. The main contract, typically called TetherToken, is built on a hierarchy of smaller contracts and libraries that each provide specific functionality. These include:

SafeMath Library

SafeMath is a library that provides safe arithmetic operations like addition, subtraction, multiplication, and division with built-in checks for overflow and underflow errors. In the USDT contract, SafeMath is used for all calculations involving balances and total supply. This was essential because older Solidity versions (prior to 0.8) did not have native overflow protection. Although newer Solidity versions include this by default, USDT’s code was written before this feature existed.

Ownable Contract

This module provides access control by assigning ownership to one address. The contract deployer becomes the initial owner, and the onlyOwner modifier restricts sensitive operations to this owner. Tether uses this to make sure only its authorized accounts can mint or manage the USDT tokens.

BasicToken and StandardToken

These contracts implement the standard ERC-20 token logic. BasicToken stores balances and implements a simple transfer function. StandardToken builds on this with support for allowances through approve and transferFrom, enabling delegated transfers.

Tether’s implementation also includes optional transaction fee logic. Both the transfer and transferFrom functions calculate a fee as a percentage of the transfer amount. Two parameters control this: basisPointsRate and maximumFee, which can be set via the setParams() function. These fees are currently set to zero but can be activated by the owner. The formula used is:

fee = (value * basisPointsRate) / 10000, capped at maximumFee.

The fee amount is deducted from the sender and credited to the owner’s account. The remainder goes to the recipient. This feature is currently inactive, but it exists as a possible future monetization tool or anti-spam mechanism.

Pausable Contract

The Pausable module allows the owner to pause or unpause the contract during emergencies. When paused, key functions like transfer are disabled using the whenNotPaused modifier. The owner can call pause() to activate this mode and unpause() to resume normal operation. This acts like a safety switch in case of bugs, hacks, or legal issues.

BlackList Contract

This module allows Tether to block specific wallet addresses. The owner can call addBlackList(address) to mark an address as restricted using the isBlackListed mapping. Any attempt to transfer from a blacklisted address will be blocked with a require(!isBlackListed[from]) check.

Tether also has a destroyBlackFunds(address) function. This allows the owner to erase all tokens held by a blacklisted address. It sets the address’s balance to zero, reduces the total supply, and emits a DestroyedBlackFunds event. While rarely used, this feature enables Tether to remove illicit or sanctioned funds from circulation. Tether has used this capability to freeze over 2,000 wallets, amounting to more than 2.5 billion USDT.

UpgradedStandardToken (Upgrade Mechanism)

Instead of using a proxy-based upgrade design, USDT uses a deprecated-forwarding model. The contract has a boolean deprecated flag and an upgradedAddress variable. When an upgrade is needed, Tether deploys a new contract and calls deprecate(newAddress). This marks the old contract as deprecated and stores the address of the new version.

After that, any function call to the old contract, like transfer, is rerouted to the new contract using wrapper functions such as transferByLegacy. This design lets users continue using the old contract address, while the logic is executed in the upgraded version. This simplifies user experience during upgrades.

Example flow:

- User calls

transfer()on the old contract - If deprecated is true, the call is forwarded to

transferByLegacy()on the new contract - The new contract executes the logic and updates state

This method avoids breaking integrations and wallet addresses, even though it differs from the common delegate-call or proxy approach.

Contract Inheritance and Architecture

All these modules come together in the main TetherToken contract. Through Solidity’s multiple inheritance, TetherToken integrates the features of:

Ownablefor ownership and admin rightsPausablefor emergency stoppingBlackListfor address controlBasicTokenandStandardTokenfor ERC-20 complianceSafeMathfor arithmetic safetyUpgradedStandardTokenfor future migrations

The result is a full-featured smart contract with standard ERC-20 logic and additional administrative and compliance tools.

Visual overview:

The contract architecture includes logic for minting, pausing, blacklisting, fee calculation, and seamless upgrade support. Each function is carefully scoped using modifiers like onlyOwner or whenNotPaused to ensure operational security.

Tron Implementation

The USDT contract on Tron is nearly identical to its Ethereum counterpart. Since Tron’s smart contract language is similar to Solidity, Tether was able to reuse most of the same logic. The Tron version also includes owner controls, blacklisting, pausing, and upgrade support.

One key improvement on Tron is that its contract strictly follows the expected function return values. On Ethereum, the original USDT contract did not return a boolean value from transfer, which caused compatibility issues. On Tron, this behavior is fixed, making it easier for developers to integrate.

Summary

Tether’s smart contract design is powerful and centralized. It gives the issuer complete authority to manage the token lifecycle, enforce compliance, respond to emergencies, and upgrade infrastructure. While this level of control may seem controversial in decentralized finance, it reflects Tether’s priority on operational stability, legal alignment, and large-scale usage in payments and finance.

Tether’s Centralized Controls and Smart Contract Behavior on Tron

Tether’s smart contract on the Tron blockchain (called TetherToken on Tron) mirrors the functionality of its Ethereum counterpart. It includes key administrative controls like minting authority, the ability to pause the contract in emergencies, blacklisting specific addresses, and burning blacklisted tokens. These modules ensure that Tether Ltd retains control over USDT’s circulation and usage across the network.

One notable enhancement in the Tron implementation is adherence to standard function definitions. Unlike Ethereum’s version, which does not return a boolean on transfer or transferFrom, Tron’s smart contract returns proper boolean values. This avoids compatibility issues with wallets, exchanges, and smart contracts that depend on standard behavior. Overall, the architecture of USDT across blockchains is robust but intentionally centralized, enabling Tether to maintain operational control, enforce compliance, and respond to regulatory demands. While this centralization stands in contrast to decentralized crypto ideals, it is an intentional tradeoff made to support stability, legal compliance, and institutional use.

Off-Chain Reserve Management: How Tether Backs USDT

While on-chain smart contracts govern how USDT tokens are transferred on public ledgers, the true source of their value lies off-chain. Tether Ltd claims that every USDT token in circulation is backed by real-world assets held in its reserves. These reserves span multiple asset types including U.S. dollars, U.S. Treasury bills, secured loans, and other liquid instruments.

By mid-2024, Tether reported holding approximately 118.4 billion USD in assets, backing around 114 billion USDT in circulation. This left a buffer of several billion dollars, which Tether refers to as excess reserves or shareholder equity. A large portion of the reserve (nearly $100 billion) is invested in U.S. Treasury bills, providing safety, liquidity, and steady yield.

Minting USDT (Token Issuance)

When an institutional customer or trading platform wants to mint USDT, they follow a standard process:

- The customer wires fiat currency (usually U.S. dollars) to Tether’s bank account.

- Once the fiat is received, Tether uses its owner privileges on the blockchain to mint new USDT tokens. This is done by calling the

issue(amount)function, which increases total supply and credits Tether’s issuance address. - Tether then sends the newly minted tokens to the customer’s blockchain wallet.

At this point, the newly issued USDT tokens are 100% backed by corresponding fiat in Tether’s reserve accounts.

Redeeming USDT (Token Burning)

When customers wish to convert USDT back to fiat:

- The customer sends USDT tokens back to a specified Tether-controlled wallet.

- Tether uses the

redeem(amount)function to burn the tokens on-chain, removing them from circulation. - Tether then transfers the equivalent amount of fiat from its reserves to the customer’s bank account.

This ensures that the supply of USDT in circulation accurately reflects the fiat assets held by Tether at any given time.

Full Lifecycle of a Token (Mint and Redeem)

This mint-burn cycle allows Tether to tightly manage supply and ensure that each token remains pegged to one U.S. dollar. Here is a simplified view of the full process:

- Step 1: User deposits fiat to Tether’s bank account (off-chain).

- Step 2: Tether mints new USDT via smart contract and credits its issuance address.

- Step 3: Tokens are transferred to the user’s blockchain wallet.

- Step 4: For redemption, user sends USDT back to Tether.

- Step 5: Tether burns the tokens using

redeem(). - Step 6: Fiat is released from reserves and wired to the user.

This structure creates trust in the token’s redeemability and supports its widespread use across exchanges and wallets.

Transparency and Revenue Model

Tether’s design depends on maintaining user confidence that the off-chain reserves are real and sufficient. In the past, Tether faced legal and reputational challenges due to unclear reporting. In 2021, it reached a settlement with the New York Attorney General and agreed to publish regular reserve attestations.

Since then, Tether has improved transparency by releasing quarterly reserve breakdowns audited by third-party firms. In addition to fiat deposits, Tether earns substantial revenue through two main channels:

- Investment Yield: By investing billions in short-term treasury bills and other interest-bearing assets, Tether earns passive income. In one quarter of 2024 alone, it reported over $1 billion in profit.

- Operational Fees: Tether imposes direct fees on issuance and redemption:

- Minimum fiat redemption is $100,000.

- Redemption fee: greater of 0.1% or $1,000.

- Issuance fee: 0.1% for direct USDT purchases.

- Account verification fee: one-time $150 (in USDT).

This means that redeeming $100,000 costs $1,000 (or 1%). Redeeming $1 million still costs $1,000 (effectively 0.1%). These fees are designed to limit retail usage directly through Tether Ltd.

Retail Users Use Exchanges, Not Tether

Most small and retail users do not interact with Tether Ltd directly. Due to the high minimums and verification requirements, they usually buy or sell USDT via crypto exchanges, OTC desks, or wallet providers. This is by design — Tether focuses its fiat banking and compliance operations on large institutional clients, reducing their overhead and exposure to individual KYC requirements.

Ethereum vs. Tron: USDT Implementations Compared

Ethereum and Tron are the two largest networks for USDT. While the token’s purpose and design remain consistent, key differences arise from the underlying blockchains:

🧱 Basic Details

| Aspect | USDT on Ethereum (ERC-20) | USDT on Tron (TRC-20) |

|---|---|---|

| Launch Date | ~November 2017 – launched as ERC-20 token on Ethereum | April 2019 – launched as TRC-20 on Tron |

| Token Standard | ERC-20 (with some non-standard function behavior) | TRC-20 (Ethereum-compatible interface) |

| Decimals | 6 decimals (1 USDT = 1,000,000 units) | 6 decimals (kept consistent with Ethereum version) |

| Contract Features | Ownable, Pausable, Blacklist, Fees, Upgradable (via deprecation). transfer() and approve() don’t return bool (legacy ERC-20 style). | Same feature set (owner, pause, blacklist) with transfer() returning bool, aligned to modern standards. |

🔒 Consensus & Security

- Ethereum (ERC-20): Uses Proof of Stake (PoS), ~15s block time. High decentralization and security, but can get congested. Requires ETH for gas.

- Tron (TRC-20): Uses Delegated PoS (27 Super Reps), ~3s block time. Low fees in TRX; often near-zero transaction cost.

🚀 Transaction Throughput

- Ethereum: ~30 TPS (shared with all other Ethereum activity). Fees can spike heavily.

- Tron: Hundreds of TPS available for USDT alone. Optimized for high-volume, retail-friendly transactions.

🌍 Adoption & Usage

- Ethereum: Dominant in DeFi (Aave, Compound, Curve), and widely used as a trading pair on centralized exchanges. High fees deter small transfers.

- Tron: Popular for exchanges, remittances, and day-to-day payments. Especially strong in Asia, Africa, and LATAM. Hosts 50%+ of total USDT by 2025.

⚙️ Integration Quirks

- Ethereum:

- Smart contracts need to handle non-standard return types (

transfer()doesn’t returnbool). - Use of

SafeERC20or low-level call workarounds required. - Broader DApp support and DeFi ecosystem maturity.

- Smart contracts need to handle non-standard return types (

- Tron:

- More centralized: activity dominated by major wallets/exchanges.

- Simpler integration due to

boolreturns. - Fewer DeFi protocols but straightforward USDT adoption.

🏗️ Tether’s Role and Chain Swaps

Tether Ltd fully controls both implementations. It:

- Holds owner keys for minting/burning and freeze rights.

- Manages cross-chain liquidity via chain swaps (e.g., burning on Ethereum and issuing on Tron).

- Sometimes pre-mints tokens on select chains to speed up issuance.

🔁 Example: A large customer may request to move $X of USDT from Ethereum to Tron. Tether burns $X on Ethereum and issues $X on Tron, keeping overall supply unchanged.

🧠 Insight: Ethereum’s version is favored for DeFi interactions and protocol integration. Tron’s version dominates for speed, cost, and real-world transfer usage (especially remittances and arbitrage across exchanges).

Governance and Control Mechanisms

Tether’s design gives significant control to the token’s issuer, which is a double-edged sword. These mechanisms allow Tether to respond to hacks, comply with regulations, and protect users. However, this also means that USDT is not censorship-resistant like Bitcoin or DAI. Here’s a breakdown of the key controls and how they’re used in the real world:

Blacklist & Freeze

Tether can blacklist an address, freezing its ability to move USDT. This is used as a compliance measure. For example, Tether has worked with law enforcement globally to freeze funds tied to crime, scams, or sanctions.

Over a 3-year period up to early 2025:

- Tether blocked over 2,090 addresses

- Froze over $2.5 billion in USDT tied to illicit activities

Tether often announces freezes publicly and sometimes helps recover funds (e.g., assisting the US Secret Service in seizing $23M from a sanctioned entity). While this improves trust with regulators, it also highlights USDT’s centralized nature — Tether can render tokens unspendable at will. It’s similar to how a bank might freeze a suspicious account.

Destroying Funds

In rare instances, Tether goes beyond freezing and destroys blacklisted USDT using the destroyBlackFunds() function. One example: in 2020, after freezing ~$1M in stolen USDT, Tether destroyed the tokens to prevent further movement. Destroying tokens permanently reduces total supply. This capability is powerful and used cautiously, with on-chain events logged for transparency.

Pausing (Global Freeze)

Tether’s smart contract includes a pause() function that can freeze all token transfers in case of a critical bug or attack. This has never been used, but its presence provides an emergency fallback. For example, if a flaw in ERC-20 was discovered, Tether could pause USDT movement while a fix is deployed. This is a centralization trade-off that adds safety.

Upgradability and Governance

Tether’s Ethereum contract contains a built-in upgrade mechanism via a deprecate() function, which points users to a new contract. This approach is non-proxy-based — the old contract forwards calls to the new one.

Tether has never used this upgrade mechanism on Ethereum, preferring contract stability. However, the mechanism allows Tether to adopt future standards (e.g., EIP-712 permit signatures) or fix vulnerabilities. All upgrades are entirely managed by Tether Ltd.

Centralized Governance and Compliance Model

Tether’s governance is fully centralized within Tether Ltd and iFinex, its parent company. There’s no DAO voting like MakerDAO. Decisions around reserves, address freezes, upgrades, and chain expansions are handled internally.

From a compliance standpoint, Tether operates as a cooperative player without being regulated like a bank. It’s based in the British Virgin Islands and avoids U.S. MSB-style regulation. Instead, Tether runs a self-managed compliance program that includes:

- Full KYC/AML for users

- Cooperation with law enforcement

- Monitoring transactions using blockchain analytics

By 2024, Tether had worked with over 200 agencies and frozen funds tied to terrorism, hacks, and sanction violations.

Transparency vs. Privacy

Tether’s transparency has improved under regulatory pressure, especially since settling with the NY Attorney General in 2021. Reserve attestations are now published quarterly. However, users still need to trust Tether’s discretion, since governance isn’t decentralized.

Product Design Rationale and Decisions

Many of the technical features we’ve discussed tie back to product and business decisions made by Tether. Let’s analyze why Tether might have made certain design choices:

Emergency Controls (Pausing & Blacklisting)

Tether’s mission is to maintain a stable $1 token that people can trust. To achieve that, they need the ability to respond to crises — whether that’s a security flaw, a regulatory demand, or a theft. The inclusion of a pause switch and blacklist functionality from the start indicates that Tether anticipated both technical and legal challenges. These controls act as safeguards to prevent systemic collapse (e.g. if millions of USDT were stolen, freezing them protects the peg and users) and to ensure that USDT would be seen as a compliant asset rather than a tool for criminals. In essence, these features were about making regulators comfortable that USDT isn’t a “rogue” money. For a payments professional, this rationale is familiar: just as banks can freeze accounts or card issuers can block stolen cards, Tether built in similar controls to manage risk and compliance.

Fee Mechanism in Smart Contract

It might seem odd that the USDT contract has code for fees that are almost never used. The rationale likely has two parts: revenue optionality and spam prevention. The ability to take a tiny fee (up to 0.2% max, per the code limits) from every transaction could provide a revenue stream to Tether if ever needed — essentially monetizing on-chain volume. As of now, Tether earns enough from other sources (interest on reserves) and zero-fee transfers make USDT more competitive, so they keep it off. But having the mechanism ready means they could activate fees in future without redeploying a new token. Secondly, if the network were ever flooded with microtransactions or attacked via dust spam, a small fee could be disincentivizing. That mirrors what many centralized payment systems do by reserving the right to impose fees to manage load or cover costs. Tether built that flexibility into the token itself (and then set it to zero by default). It reflects prudent foresight design for all scenarios, even if you don’t need them initially.

Multi-Chain Deployment

Tether’s aggressive expansion to every credible blockchain was a strategic product decision to maintain USDT’s dominance. When Ethereum became expensive, rather than wait and lose users, Tether moved onto Tron, which offered an immediate solution for low-cost transfers. They did the same with other chains like EOS, Algorand, Solana, Polygon, etc., whenever those ecosystems showed growth. The rationale is simple — be where the users are. This multichain strategy also decentralizes risk: if one blockchain has an issue, USDT on other networks is unaffected. From a product design view, multichain USDT gives user choice (you can hold USDT on a chain that suits your needs best). It does add complexity for Tether (managing multiple supply pools), but the benefit is evident in USDT’s sustained market share. Compare this to competitors like USDC, which focused mostly on Ethereum for a long time and came later to other chains; Tether’s early move to Tron, for instance, paid off massively as Tron became a dominant stablecoin network. Another rationale is resilience and redundancy — if Ethereum were to face regulatory pressure or technical failure, Tether operations could continue on other chains. This makes USDT more robust as a product.

High Redemption Minimum and KYC

Tether set a $100k minimum for direct fiat redemption and requires thorough KYC for account creation. This was a conscious choice to target institutional clients and exchanges rather than retail users. The rationale is twofold: compliance (large clients are fewer and easier to monitor for AML purposes) and operational efficiency (processing thousands of $500 redemptions would be impractical and costly; better to have a few big redemptions). By making small redemptions uneconomical (with a $1k fee), Tether effectively outsourced retail liquidity to the crypto market itself. If a small user wants $100 of USDT converted to cash, they will likely trade it on an exchange for $100, rather than go to Tether. This keeps Tether from being a consumer-facing money transmitter and reduces their regulatory burden in many jurisdictions. It’s a design decision that helped Tether scale — they focused on being a backend utility for large players, and the market (exchanges, OTC desks) handles distribution to individuals.

Conservative Upgrade Approach

Tether’s contract is notably old (written in 2017 Solidity), yet it hasn’t been replaced or significantly changed on Ethereum. One reason is that stability and simplicity were prioritized over constant innovation. USDT’s value proposition is stability; changing the contract unnecessarily could introduce risk. The upgrade mechanism exists if absolutely needed, but by avoiding upgrades Tether ensures consistent operation. Moreover, any contract migration would require coordination with hundreds of exchanges and applications, which could be disruptive. So the implicit strategy is “if it ain’t broke, don’t fix it.” Only in a dire situation or a major improvement would they use the upgrade. The decision to include an upgrade path but not use it unless necessary is akin to having a fire escape – it’s there for emergency, not for regular use.

Economic Model and Reserve Economy

The economics of Tether and USDT revolve around maintaining a 1:1 peg to the dollar and ensuring Tether Ltd is profitable and sustainable in doing so. USDT’s economic model can be described in terms of reserves, seigniorage, and fee revenue:

100% (or More) Reserves

The foundational economic principle is that every USDT in circulation corresponds to $1 (or equivalent value) held by Tether. In the early years, there was controversy over whether reserves were always fully maintained, but by policy and attestation, Tether now operates on a full-reserve model. This means all outstanding USDT liabilities are matched by assets in its balance sheet.

These reserves have evolved into a mix of cash, treasury bills, money market funds, secured loans, corporate bonds, and a small proportion of other investments like Bitcoin. As of 2024, a majority of reserves are in U.S. Treasury bills, giving Tether the characteristics of a large money market fund. Notably, Tether reported over $5 billion in excess reserves in 2024, a sign of over-collateralization that boosts confidence.

Seigniorage and Interest Income

Seigniorage is the profit made by holding the funds users deposit in exchange for USDT. When users redeem, Tether returns those funds, but in the interim, Tether earns interest—particularly valuable in a high-rate environment. For example, $80 billion in treasuries at 4-5% generates $3–4 billion annually. These profits are a key revenue source.

USDT acts as a giant float of dollar-equivalents: the more in circulation, the more interest-earning reserves held by Tether. Since users don’t earn interest on USDT, Tether keeps it. This model allows Tether to operate like a money market fund with high profit margins, albeit outside the traditional banking framework.

Fees and Other Revenue

Tether charges a 0.1% fee on minting and redemptions (with a $1,000 minimum), which contributes additional revenue during high-volume periods. For instance, if $10 billion is redeemed in one quarter, this would generate $10 million. While minor compared to interest income, these fees are valuable in volatile markets.

Tether may also earn from other sources such as venture investments or crypto projects, although these carry more risk. The overall model has proven highly profitable in 2023–2025 due to rising interest rates and the high demand for stable USDT.

Peg Stability Mechanism

Tether maintains USDT’s peg to $1 primarily through arbitrage and trust. When USDT drops below $1 (e.g., $0.995), traders buy it and redeem for $1, pushing the price back up. If it rises above $1, they deposit fiat with Tether, mint new USDT, and sell it.

This mechanism relies on trust in Tether’s ability and willingness to redeem USDT at any time. Direct redemption is mostly used by institutions due to fees and KYC friction. In turbulent markets, USDT has briefly lost its peg but generally restores quickly. During the 2023 USDC crisis, USDT gained market trust due to stronger reserves and minimal exposure to failed U.S. banks.

Growth and Contraction

USDT’s supply expands and contracts based on demand. In bull markets, USDT issuance rises as users seek dollar-pegged stability. In bear markets or during competitor gains (e.g., USDC), redemptions increase and supply contracts. Tether maintains reserve liquidity to handle large redemptions without selling long-duration assets at a loss.

The flexibility of minting and burning allows USDT to adapt to market conditions. The use of highly liquid assets, particularly short-term U.S. Treasuries, ensures that Tether can always fulfill redemptions, giving confidence to users and regulators alike.

Real-World Use Cases and Adoption

Why has USDT become so significant in fintech and crypto payments? The answer lies in its real-world utility across various domains:

Cross-Border Value Transfer

One of USDT’s primary use cases is as a cross-border payment medium. In regions with currency instability or strict capital controls, people have turned to USDT as a dollar substitute. For example, in parts of Latin America, Africa, the Middle East, and Southeast Asia, USDT is used for remittances and even day-to-day transactions.

Instead of relying on local fiat (which might be inflating or hard to exchange), individuals receive or send USDT via mobile wallets. The receiver can decide whether to keep it in crypto or convert to local cash via peer networks or exchanges. This is a grassroots use case that emerged out of necessity essentially using USDT as a stable store of value and transfer mechanism when banking channels are slow or inaccessible.

The Tron network’s popularity for USDT is largely driven by this: negligible fees enable micropayments and remittances even of $10 or $50 worth, which would be infeasible on expensive chains. Case in point: A migrant worker in Europe can send $200 of USDT to family in Asia within minutes and for pennies in fees using Tron or another chain, whereas doing an international bank wire could cost $30 and take days. The family might then use local exchangers to swap USDT for cash or increasingly find merchants who accept USDT directly.

In effect, USDT is playing the role that mobile money or hawala networks have in the past a digital cash that moves easily across borders.

Crypto Trading and Liquidity

USDT’s original impetus was to provide a stable trading pair for crypto markets. On exchanges (especially those outside the US like Binance, OKX, Huobi, etc.), a huge proportion of trading pairs are denominated in USDT (BTC/USDT, ETH/USDT, etc.).

Traders favor USDT because it lets them exit volatile positions into a stable asset without leaving the crypto exchange. USDT thus serves as the “cash sideline” within the crypto ecosystem. This drives enormous demand: virtually every crypto trader holds some USDT at times.

The liquidity provided by USDT markets is one reason it overtook competitors – many altcoins list a USDT pair as primary. Market makers and arbitrageurs also rely on USDT to move capital between exchanges (if BTC is cheaper on one exchange and pricier on another, they will often use USDT to quickly trade and transfer value during arbitrage).

These use cases require USDT to be stable and widely accepted, which becomes a self-fulfilling cycle: because everyone trusts and uses USDT, new exchanges and platforms also adopt USDT as a default stablecoin. The network effect is strong. In 2019, USDT’s trading volume was so high it surpassed Bitcoin’s, making it the most traded cryptocurrency in the world – a testament to its role as the grease in the crypto market engine.

Decentralized Finance (DeFi) Integration

In the DeFi boom (2020–2022), stablecoins became the lifeblood of protocols on Ethereum and beyond. USDT is one of the top stablecoins used in DeFi, although it shares the space with USDC and DAI.

Users supply USDT as collateral on lending platforms (like Aave, Maker, Compound) to earn yield or to borrow other assets. USDT is provided as liquidity in automated market maker pools (like on Uniswap, Curve) to facilitate swaps between stablecoins and other tokens.

It’s also used in yield farming strategies and as a unit of account for various synthetic assets or derivatives. However, USDT’s centralized nature and historical opacity caused some DeFi communities to treat it with caution – for instance, MakerDAO initially did not want USDT as collateral, and some pools offer lower yields on USDT due to perceived risk of freeze.

Over time, though, USDT’s sheer volume meant DeFi couldn’t ignore it: Curve’s stablecoin pools, for example, include USDT alongside USDC and others, providing deep liquidity for swaps. One unique DeFi integration challenge was the non-standard ERC20 behavior of USDT (no return bool). Many DeFi smart contracts had to implement workarounds (using low-level calls for USDT or specialized libraries). Projects like OpenZeppelin’s SafeERC20 library included built-in support to handle USDT’s quirks.

This underscores that while USDT is ubiquitous, its technical differences required minor adaptations in decentralized applications. Nonetheless, USDT’s presence in DeFi remains significant – it’s a common base asset in yield farming, and it’s part of the “tri-pool” (USDT, USDC, DAI) that forms the backbone of stablecoin liquidity on Ethereum’s Curve protocol.

Merchant Payments and E-Commerce

An emerging use case is direct payments in USDT for goods and services. Some businesses, especially in Asia and Eastern Europe, now accept USDT for payments – effectively treating it like a digital dollar.

For example, freelancers in countries with limited PayPal access request payment in USDT; import/export businesses settle invoices in USDT to avoid swings in local currency or difficulties with USD banking. Tether’s zero-fee on-chain transfers (on cheap networks) make it viable for B2B payments. Even some point-of-sale providers in regions with currency issues have started integrating USDT.

While not as widespread as trading use, this is a growing area where stablecoins like USDT fill a gap – acting as a stable medium in digital commerce without needing a bank’s involvement.It should be noted that volatility in crypto is not a concern here since USDT is stable, but counterparty risk is: a merchant accepting USDT must trust it won’t depeg or be frozen.

So far, in jurisdictions where this is popular, users seem comfortable with that risk given the alternative of unstable local currency.

Hedging and Safe-Haven Asset

In crypto-market downturns, investors often flee to stablecoins to preserve value. USDT, being the largest, sees surges in usage during such times. It essentially serves as the “cash” component of crypto portfolios.

Unlike converting to actual USD (which may require bank withdrawals and could be slow), moving into USDT is instant and keeps funds in the crypto realm ready to redeploy. This makes USDT a strategic asset for traders managing risk.On the other side, in certain economies, people use USDT to hedge against local currency devaluation – not necessarily to spend it, but simply to hold a stable asset.

In countries like Turkey, Argentina, Nigeria (with high inflation or weak currencies), some individuals prefer saving in USDT (using local crypto exchanges or even peer-to-peer markets to acquire it) rather than the local currency.They treat USDT as digital dollar savings, given that accessing actual USD might be restricted. Chainalysis noted that regions like Latin America and Africa are among the fastest-growing in stablecoin adoption due to these use cases.

Regulatory Classification

As of 2025, there isn’t yet a unified global approach to stablecoin regulation, but many jurisdictions are drafting rules (for instance, the EU’s MiCA will require stablecoin issuers to meet certain reserve and audit standards). Tether has not publicly announced applying for any specific license like a bank or e-money license.

Instead, Tether Ltd operates out of the British Virgin Islands (BVI) and historically from Hong Kong, leveraging the fact that its business is international and not clearly under the jurisdiction of any one nation for now. However, Tether has faced regulatory actions: in 2021, the U.S. CFTC fined Tether for misstatements about reserves, and the New York Attorney General’s office reached a settlement barring Tether from New York and mandating quarterly reports. These actions pushed Tether to improve transparency (hiring accounting firms to attest reserves) and to segregate reserves properly.

Tether’s official stance is that it complies with applicable laws and cooperates with authorities, but it has intentionally avoided offering services (like direct retail redemption) that would clearly make it a Money Service Business in the U.S. or EU.

KYC/AML Policies

Tether requires full KYC for anyone who wants to create or redeem USDT on its platform. This means collecting personal or corporate documentation, just like a bank would for a new account. By doing so, Tether can track who is injecting or withdrawing funds from the USDT system.

The vast majority of USDT trading happens off Tether’s own platform (on crypto exchanges), which have their own KYC standards if regulated. But within Tether’s operations, they maintain an internal compliance program and have reportedly filed Suspicious Activity Reports when needed.

Tether is also known to use blockchain analytics tools (like Chainalysis) to monitor USDT transactions for illicit patterns. In 2023, Tether formed an alliance with Tron and analysis firm TRM Labs to combat crypto crime, launching a “financial crime unit” that had already frozen millions in scams by late 2024. These steps indicate Tether’s effort to self-police its ecosystem to fend off concerns that USDT could facilitate money laundering or sanctions evasion.

Freezing and Blacklist Policy

Tether actively freezes addresses when required. According to its published policy and statements, Tether will freeze funds only after receiving a verified request from law enforcement or if a hack/theft has occurred and the rightful owner asks (with evidence) for help to freeze stolen funds. They do not freeze at mere allegation; they need a legal basis.

Tether has emphasized that unlike a permissionless decentralized system, the ability to freeze is a feature that has helped stop criminals – highlighting cases where they froze ransom funds or assisted in recovery of exchange hacks. A recent report (by AMLBot) did critique Tether for a delay in blacklisting certain addresses which allowed criminals to move $78M before a freeze took effect. The delay (apparently a ~40-minute gap on Tron between a request and enforcement) suggests that Tether’s process isn’t instantaneous – it may involve manual review.

This was a learning moment; Tether might improve responsiveness, but it also shows the limits of centralized control (it’s effective but not infallible in real-time).

Transparency and Audits

One longstanding demand from the community has been a full audit of Tether’s reserves. Tether has provided attestations (snapshots by an accounting firm) but not a full independent audit of historical operations. They have cited the difficulty of auditing a continuously moving reserve across multiple banks and assets.

Instead, they publish quarterly reports certified by accountants (e.g., BDO Italia in recent times) showing assets and liabilities. While these attestations satisfy basic transparency, some regulators might push for stricter oversight. Tether’s move to hold high-quality assets (like T-bills) and eliminate riskier holdings (they phased out nearly all commercial paper by 2022 after questions arose) was likely aimed at appeasing regulators and increasing trust.

Indeed, by late 2022, Tether reported zero commercial paper and more in U.S. treasuries to silence rumors about Chinese commercial paper exposure that had worried the market. This adaptability shows Tether is sensitive to market and regulator sentiment and willing to adjust reserve composition accordingly.

Comparison with Circle/USDC

It’s helpful to compare Tether’s approach with that of Circle’s USDC, as both are top stablecoins but with different philosophies.

Circle is a U.S. company, regulated as a licensed Money Service Business and expected to register under new stablecoin laws if enacted. USDC’s reserves are held with U.S.-regulated financial institutions and are audited monthly. Circle has from inception been very transparent (daily reporting of reserve composition, fully cash/treasury backed) and has a reputation for compliance (they froze addresses when required – notably, Circle froze USDC in Tornado Cash-related addresses as soon as OFAC sanctioned them in 2022).

The advantage of USDC is higher transparency and likely lower regulatory risk for institutions (it’s more “approved” in the U.S. eyes). The disadvantage (from a decentralization perspective) is similar to Tether – centralized control – plus USDC’s heavy U.S. regulation meant when the U.S. banking system wobbled (SVB collapse), USDC was directly impacted (they had $3B stuck in a failed bank, causing a temporary depeg).

Tether, being outside the U.S. banking system for the most part, had no exposure in that incident and even looked safer to some. In terms of blocking addresses, analyses have shown both Tether and Circle do it, but Tether historically has done it slightly more often simply because USDT’s usage in certain high-risk parts of the world is greater. Tether has blocked addresses linked to hacks on Ethereum and Tron, while Circle’s notable freezes have been on Ethereum.

Both face criticism from privacy advocates for these capabilities.

Regulatory Outlook

Looking forward, Tether has signaled willingness to embrace sensible regulation – they just don’t want to be shackled by overly restrictive rules that could hamper the crypto market. They often point out that USDT brings dollar access to populations that can’t get it otherwise, framing it as a financial inclusion tool.

Regulators, however, are wary of the systemic risk stablecoins could pose if not properly supervised (they worry about runs, reserve quality, and usage in illicit finance). It’s likely that major jurisdictions will classify systemically important stablecoin issuers and demand things like regular audits, liquidity requirements, and perhaps registration. If that happens, Tether will have to either comply (which could mean more disclosures and perhaps moving to hold reserves only in very safe banks/central bank accounts) or face being cut off from those jurisdictions.

So far, Tether’s strategy has been to demonstrate goodwill (freezing bad actors, publishing data) without sacrificing its operational flexibility (being based in a friendly jurisdiction and not opening up entirely to regulators). It’s a fine line to walk.

For payments professionals evaluating USDT, the key compliance point is: Tether is centralized and can take actions to prevent illegal use, but it’s not as tightly regulated or supervised as a traditional financial institution. That gap is narrowing as the industry matures, but it remains a differentiator among stablecoins.

Comparison with Other Stablecoins (USDC, DAI, etc.)

To put Tether’s model in context, let’s compare it to two other major categories of stablecoins: USD Coin (USDC), another fiat-backed centralized stablecoin, and DAI, a decentralized crypto-collateralized stablecoin. We’ll also consider algorithmic stablecoins (like the now-defunct UST from Terra) as a contrast. Each has different design trade-offs.

USDT (Tether) vs USDC (Circle)

Both are fiat-backed and pegged to USD, but USDC is often seen as the more transparent and regulated sibling. Circle, the issuer of USDC, publishes very frequent attestations and holds reserves strictly in cash or short-term U.S. treasuries, similar to Tether’s current approach.

Circle’s operations are U.S.-based, and they work closely with regulators. For example, Circle is registered with FinCEN and obtained a New York BitLicense for USDC. USDC’s smart contract is also more standardized (it returns bool on transfers, is upgradeable via proxy, etc.).

Circle’s governance includes clear compliance policies and features like address blacklisting (they too can freeze funds). In practice, Circle has frozen fewer addresses than Tether but notably followed OFAC sanctions promptly such as blacklisting Tornado Cash addresses immediately upon U.S. government orders.

Pros of USDC:

- Higher transparency and frequent reserve disclosures

- Lower credit risk (fully backed and insured where possible)

- Strong regulatory alignment, preferred by U.S.-based institutions

Cons of USDC:

- Heavily centralized, deeply integrated into the U.S. regulatory framework

- Subject to political pressure (e.g., OFAC blacklists)

- Slightly smaller market cap (~$60B vs Tether’s $80B in mid-2025), resulting in less liquidity in some markets

For most purposes, USDC and USDT are interchangeable at par. However, during specific events, traders may observe divergence. For example, during the SVB crisis, USDC briefly traded at ~$0.90, while USDT maintained its $1 peg, highlighting differing market perceptions of risk.

USDT vs DAI (MakerDAO)

DAI is fundamentally different: it is not backed by dollars held in banks but by over-collateralized crypto assets (like ETH) locked in smart contracts. Users generate DAI by taking loans against their crypto holdings on MakerDAO.

This dynamic means DAI’s supply can expand or contract based on crypto market conditions and user demand for loans. It maintains its $1 peg through incentives and arbitrage — when DAI > $1, users can mint DAI cheaply; when DAI < $1, users are incentivized to buy and repay loans.

Pros of DAI:

- Decentralized governance via DAO (no central issuer can freeze or manipulate supply)

- Fully on-chain and transparent collateral

- Censorship-resistant and aligns with crypto’s ethos

Cons of DAI:

- Lower scalability (typically $1.5 of crypto is required to mint $1 of DAI)

- Dependent on crypto market health; in downturns, peg stability can be tested

- Some centralization creep: by 2023, over 50% of DAI was backed by USDC, making it indirectly dependent on Circle

Interestingly, in efforts to stabilize DAI, MakerDAO introduced USDC as part of its collateral. This created an ironic centralization risk Circle’s actions could influence DAI’s performance. MakerDAO has since worked to diversify collateral (with real-world assets and alternative stablecoins) to address this issue.

DAI’s peg has generally held strong, but there have been exceptions. In March 2020, due to a liquidity crunch, DAI spiked to $1.10 demonstrating how even decentralized stablecoins can face stress under exceptional market conditions

USDT vs Algorithmic Stablecoins

March 2023 offered a reality check for DAI when it dipped to ~$0.90 due to USDC’s temporary depeg a reflection of DAI’s collateral exposure to centralized stablecoins. This event underscored that even decentralized systems like DAI are not entirely immune to systemic stress if their dependencies are centralized. For payments professionals, DAI represents an algorithmic approach to money — one with no central company behind it, but also no guarantees beyond the underlying code and crypto collateral.

In contrast, algorithmic stablecoins — a category including the infamous TerraUSD (UST) take an entirely different route. These are typically not fully backed by real assets. Instead, they use algorithms and incentive structures to try to maintain a stable peg. Often, this involves a secondary token designed to absorb volatility.

TerraUSD (UST) was the highest-profile example. By early 2022, it had grown to become the third-largest stablecoin. UST maintained its peg using a mint/burn mechanism tied to LUNA (a volatile governance token) and arbitrage incentives. This design worked — until it didn’t. In May 2022, confidence evaporated, and a classic death spiral began. UST plummeted well below $1, dragging LUNA down with it and wiping out nearly $40 billion in value. It was one of the largest collapses in crypto history and served as a brutal reminder that elegant tokenomics don’t substitute for hard collateral.

Compared to UST, Tether’s fully reserved model appears considerably more stable. There’s no scenario in which $1 of USDT becomes worthless unless Tether commits fraud or its reserve assets fail entirely. That simplicity and collateral base even if centralized offer a level of safety algorithmic designs have repeatedly failed to match.

Other attempts at algorithmic stablecoins such as Basis, Empty Set Dollar, and Ampleforth have either failed or remain niche. One partial success story is FRAX, a hybrid model that blends partial collateralization with algorithmic controls. However, even FRAX is small in scale relative to USDT and must contend with similar trust and risk perception issues.

Pros of Algorithmic Stablecoins:

- Innovative structures with potential for high capital efficiency

- Decentralized by design and not tied to fiat or banking rails

- If successful, could scale independently of reserve requirements

Cons of Algorithmic Stablecoins:

- Extremely fragile in practice, with a poor track record of success

- Susceptible to “bank run” dynamics and confidence collapses

- Market trust is difficult to establish without transparent and verifiable backing

- Regulatory scrutiny is high due to systemic and consumer protection concerns

Ultimately, Tether’s USDT has found a middle ground. It’s not decentralized like DAI, but that centralization has enabled it to build institutional-grade stability, liquidity, and operational resilience. Its centralized reserves and active management helped it weather market storms that toppled other projects.

Meanwhile, users and institutions seem to gravitate toward the stablecoin that matches their needs:

- USDT for liquidity, global reach, and flexibility (especially outside the U.S.)

- USDC for transparency and regulatory assurance (favored by U.S.-based institutions)

- DAI for decentralized applications and DeFi-native use cases

- Algorithmic stablecoins remain speculative, and mostly sidelined post-UST collapse

Quick Pros/Cons Breakdown for Professionals

Tether USDT

Pros: Most liquid and widely accepted, multi-chain support, cheap and fast transfers on networks like Tron, resilient under stress, strong market adoption.

Cons: Centralized issuer, funds can be frozen, historically less transparent, minor technical inconsistencies on Ethereum (e.g., transfer() behavior), limited formal regulatory oversight.

Circle USDC

Pros: High transparency, audited reserves, strong compliance, seamless ERC-20 integration, perceived low credit risk by institutions.

Cons: Subject to U.S. regulations and jurisdiction, vulnerable to U.S. banking risks (e.g., SVB exposure), slightly less adopted outside Ethereum ecosystem.

MakerDAO DAI

Pros: Decentralized, censorship-resistant, over-collateralized, community-governed.

Cons: Growth limited by collateral requirements, peg sometimes tested in market stress, increasingly reliant on centralized collaterals like USDC, mostly used within DeFi not off-chain.

Algorithmic Stablecoins (e.g., UST)

Pros: If successful, offer full decentralization and capital efficiency, not reliant on fiat.

Cons: Extremely fragile, history of collapse, lack of user confidence, prone to systemic failure without hard collateral, under intense regulatory scrutiny.

Evolution and Architecture of Tether

Tether’s USDT began in 2014 on the Omni protocol as a fringe experiment and has since become a foundational component of the global crypto-financial ecosystem. By combining blockchain technology with the utility of a U.S. dollar peg, it has enabled a range of use cases including cross-border remittances, institutional arbitrage, and high-frequency trading. This integration effectively created a digital dollar standard within crypto networks.

The technical architecture of USDT reflects a strong emphasis on control and operational safety. Tether’s Solidity smart contract includes modules like SafeMath for overflow protection, Ownable to manage administrative privileges, pausing mechanisms for emergencies, blacklisting functionality to comply with legal obligations, and an upgradeable structure to accommodate future needs. These design choices have drawn criticism from decentralization purists, but they have helped USDT survive market crises and support law enforcement. Tether has frozen over $2.5 billion in illicit funds in coordination with authorities.

Several features in the system are configurable. The minting and redemption fee is currently set to zero, but the infrastructure allows it to be activated. Tether’s multi-chain deployment strategy enables support on Ethereum, Tron, Solana, and other networks, catering to users based on transaction speed and cost. A $1,000 minimum redemption threshold is maintained to streamline operations and reduce load. Underlying this design is a commitment to full reserve backing and a consistent $1 peg.

The economics behind Tether reveal a profitable business model. It issues a fully backed digital currency and earns interest income from reserves held in U.S. Treasury bills and other instruments. By 2024, Tether had generated billions in excess reserves. This reserve-backed approach supports operations without charging interest or fees for most users and has helped Tether scale sustainably.

Over the years, Tether has faced significant scrutiny. Early concerns about whether reserves were truly in place led to changes in operations. The company began issuing regular reserve attestations and moved away from commercial paper toward safer assets like U.S. Treasuries. Accounting oversight is now provided by firms such as BDO Italia, helping to improve credibility and address regulator concerns.

On a technical level, USDT behaves differently across chains. For example, sending $50 in USDT might cost $10 in fees on Ethereum during periods of high congestion, while the same transaction on Tron could cost under one cent. This has led to a bifurcation in usage. Tron hosts the majority of USDT supply for low-cost transactions, while Ethereum remains important for smart contract use cases. Supporting multiple chains has made USDT highly adaptable and accessible.

When comparing Tether with other stablecoins, it becomes clear that different designs serve different priorities. Tether is known for liquidity and global usage. Circle’s USDC is favored for transparency and regulatory compliance. MakerDAO’s DAI champions decentralization. Algorithmic stablecoins have offered creative approaches but failed to establish reliable market performance. These differences show how each stablecoin targets a unique combination of security, accessibility, and control.

Tether’s USDT represents a practical version of a digital dollar. It is not fully regulated like central bank digital currencies or bank-issued coins, and it is not purely decentralized like crypto-native tokens, but it is effective enough to be adopted globally. It uses decentralized networks while operating under centralized management, allowing it to serve both institutional players and individuals in emerging markets. Understanding how Tether works from both a technical and economic perspective helps illustrate how digital value moves in the modern financial world. The trust that users place in USDT has helped it grow into a critical tool for global finance and payments.

Leave a Reply